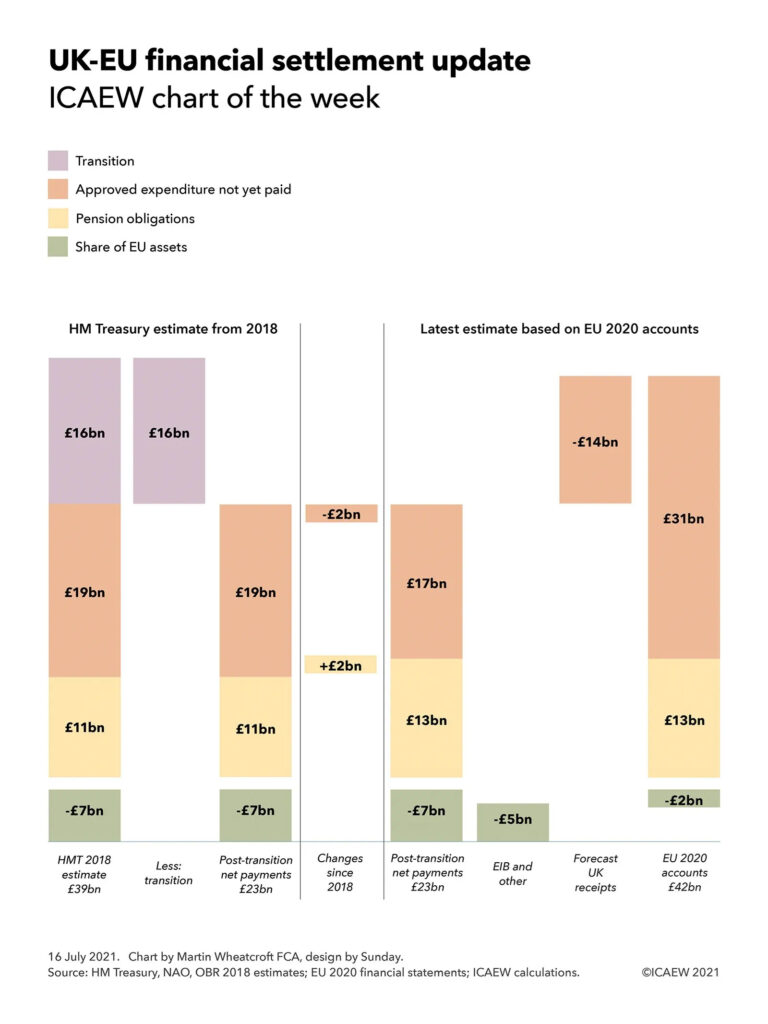

This week’s chart is on the UK-EU withdrawal agreement financial settlement. Perhaps surprisingly given recent press coverage, ICAEW’s analysis is that it remains roughly unchanged from the Treasury’s 2018 estimate.

The €47.5bn (£42bn) receivable from the UK included in the recently published EU 2020 accounts caused a kerfuffle last week, as excitement levels grew over what turns out to be a pretty much unchanged estimate for the post-transition element of the UK-EU financial settlement.

ICAEW’s chart of the week attempts to reconcile the £39bn estimate calculated by HM Treasury back in 2018 with the €47.5bn (£42bn) receivable recorded by the EU in its financial statements on 31 December 2020, the last day of the transition period. Perhaps surprisingly, given recent press coverage, ICAEW’s analysis is that the estimate for the post-transition element of the settlement of £23bn remains unchanged overall.

Much of the confusion arises because the £39bn estimate made by HM Treasury in 2018 was a net number, reflecting forecasts of gross payments to the EU by the UK government less anticipated payments by the EU and EU-related institutions back to the UK.

The chart starts by analysing the £39bn estimate into its four main component parts: Net transition payments of £16bn, the UK’s share of approved expenditure not yet paid of £19bn and pension contributions of £11bn less the UK’s share of EU assets of £7bn, with the last three elements amounting to a net £23bn amount to be settled in the post-transition period.

The transition element of £16bn is now in the past, reflecting membership dues for the then anticipated transition period of 1 April 2019 to 31 December 2020 less money coming back from the EU to the UK over the same period. In the end, this turned out to be a couple of extensions in the UK’s period of membership that resulted in a shorter transition period from 1 February to 31 December 2020 – a switch in classification for some of the £16bn from post-EU transition payments to pre-EU exit net membership cost.

The UK’s share of approved expenditure not yet paid of £19bn was also a net number, reflecting a gross amount payable to the EU for ongoing programmes at the end of 2020 less amounts coming back the other way. The OBR has been working to an estimate of €296bn for the balance of approved expenditure not paid (also known as reste á liquider or RAL), which compares with €294bn in the notes to the EU accounts once adjustments were applied to the overall total of €303bn that the EU was committed to spend as at 31 December 2020.

The calculated receivable of €35bn or £31bn does not reflect an estimated £14bn of payments by the EU to UK participants in these programmes, for example to British universities and research institutions, giving rise to a net amount in the order of £17bn, a couple of billion below the original estimate.

This slightly smaller net outflow is offset by a larger pension liability in the EU accounts, driven by a lower discount rate than originally anticipated. The UK’s €14bn or £13bn share of the €116bn liability is therefore higher than the €12bn or £11bn share of a €96bn liability that was previously forecast. In practice, the value attributable to this balance will change over time given that payments are expected to continue to 2064 or later.

Another area where the EU accounts do not provide the complete story is in the UK’s share of assets it expects to receive back as part of the withdrawal agreement. The €2bn amount in the EU accounts primarily relates to the UK’s share of fines, but it excludes the return of UK shareholdings in EU-related institutions that are owned by member states outside of the scope of the EU consolidated financial statements. Of the £5bn in this category, €3.5bn or £3bn relates to the return of the UK’s share capital in the European Investment Bank.

Despite the numbers being pretty much as expected, there still remains some uncertainty concerning the £23bn post-transition estimate in relation to the calculation of the amounts coming back to the UK, and HM Treasury and the OBR will no doubt continue to refine these estimates over the next few months and years.

The financial settlement is not the end of the UK’s financial engagement with the EU as the government has agreed to participate in a number of EU programmes from 1 January 2021 onwards, for example in Horizon pan-European scientific research, as well as working with the EU on international development programmes funded from the aid budget.