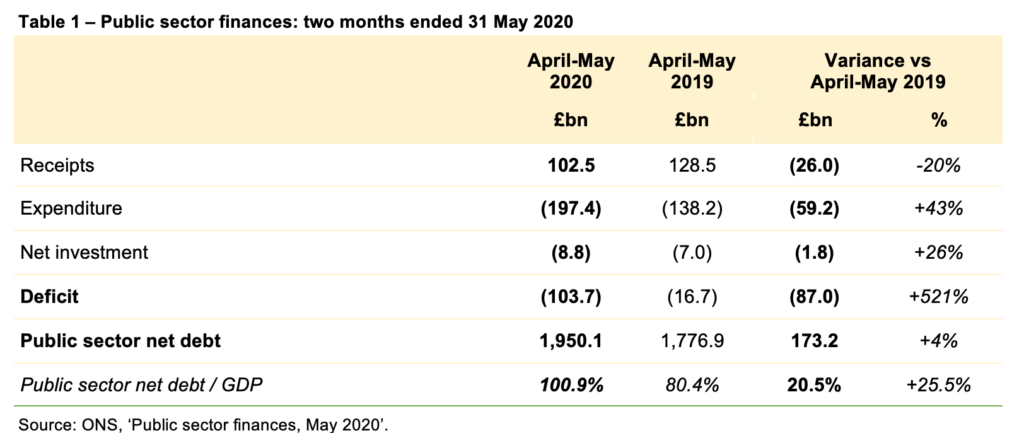

22 June 2020: The fiscal deficit of £103.7bn for April and May 2020 is over six times as large as the £16.7bn reported for the same period last year.

The latest public sector finances for May 2020 published by the Office for National Statistics (ONS) on Friday 19 June 2020 reported a revised deficit of £48.5bn for April and a deficit of £55.2bn for May 2020.

Public sector net debt increased to £1,950.1bn or 100.9% of GDP, an increase of £173.2bn (up 20.5 percentage points) compared with April 2019. This is the first time the headline debt number has exceeded 100% of GDP since 1963, although the ONS cautions that the numbers for the deficit and for GDP are both subject to potentially significant revisions.

These results reflect the substantial fiscal interventions by the UK Government to support businesses and individuals affected by the coronavirus pandemic, together with a collapse in tax revenues as a consequence of the lockdown.

The deficit of £103.7bn for the two months to May is more than the budgeted deficit of £55bn for the whole of the 2020-21 financial year set in the Spring Budget in March.

Cash funding (aka the ‘public sector net cash requirement’) for the two months was £143.5bn, compared with £1.8bn for the same period in 2019.

Some caution is needed with respect to the numbers published by the ONS, which are expected to be revised as estimates are refined and gaps in the underlying data are filled.

Alison Ring, director of public sector for ICAEW, commented:

“Significant borrowing over recent months means that this is the first time in more than 50 years that debt has been larger than GDP. And though the furlough scheme to date has cost less than originally estimated, cash funding in April and May was more than in the previous three financial years combined.

These are major milestones for the public finances and demonstrate the unparalleled impact of coronavirus, even if this is not surprising given the huge amounts of financial support the government is providing to keep the economy going through lockdown.”