ICAEW’s chart this week compares the differences in the tax payable depending on legal form – an area ripe for reform in theory, but much more difficult in practice.

Comments by the Chancellor last year suggested he might tackle one of the thorniest challenges in the UK tax system – the differences in tax paid by individuals depending on the legal form through which they conduct their business activities. However, as the controversy over IR35 has demonstrated, a significant amount of political capital is likely to be needed if changes are to be made.

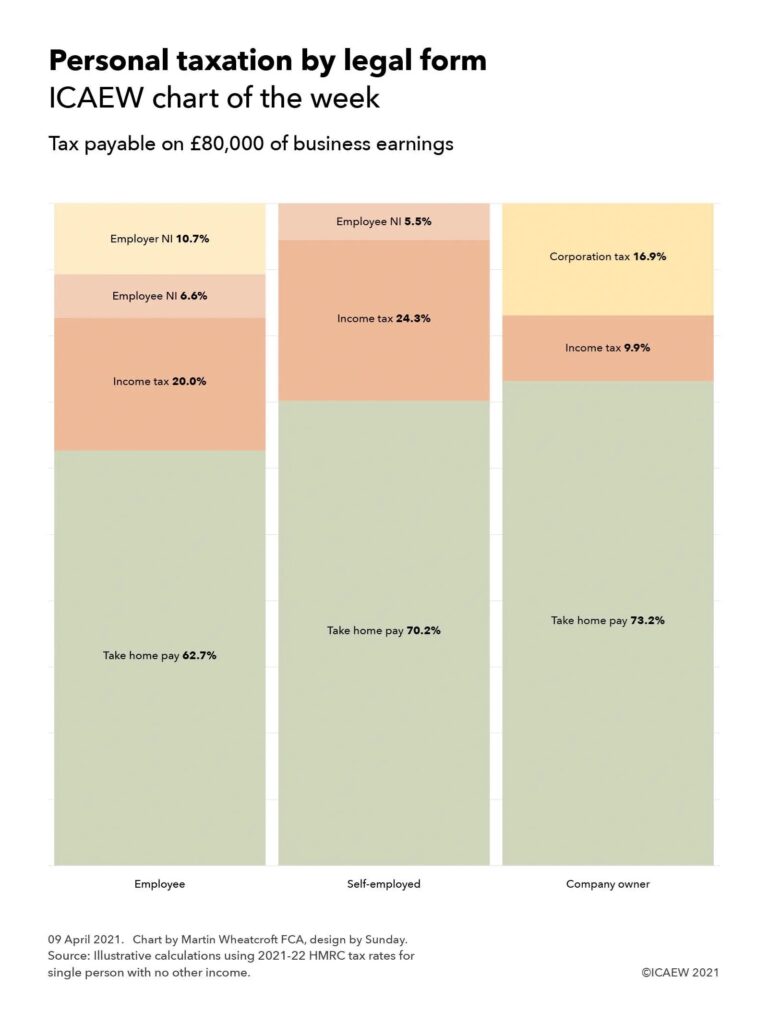

The #icaewchartoftheweek provides an illustrative example of just how significant the differences can be, with £80,000 in business earnings attracting an effective tax rate of 37.3% if paid to an employee on a salary of £71,460, 29.8% if paid to an individual who is self-employed or in a partnership, or 26.8% if earned through a company and distributed as dividends.

(It is important to note that this is a theoretical illustrative example for a single person with no other earnings and not paying any pension contributions, with the company owner in the example paying a salary equivalent to the secondary threshold for national insurance before paying the rest as dividends. Actual amounts of tax paid will of course depend on both business and individual circumstances, which can vary significantly.)

The last decade or so has seen a significant increase in the numbers of people becoming self-employed or conducting business through their own companies, and the tax authorities have been concerned about the loss in tax that has followed. One way they have sought to tackle this is by removing the tax benefits of being self-employed or operating through a company from some people, which is the approach adopted by IR35. Coming into force this month, IR35 in effect creates a new legal status of ‘deemed employee’ for tax purposes, reclassifying individuals back into the scope of employment taxes. This has proved highly controversial, accompanied as it is by extensive compliance requirements and general unhappiness by those determined to be subject to it.

Another potential approach would be to change the taxes and tax rates applying to three different forms – either by reducing the taxes on employees or by increasing them on the self-employed or those operating through companies. The former seems unlikely given the state of the public finances, but the challenge in increasing rates can be extremely politically difficult, as former Chancellor Philip Hammond found a few years ago when he proposed a relatively modest increase in the amount of national insurance to be paid by the self-employed.

Whether current Chancellor of the Exchequer Rishi Sunak will take forward a suggestion he made last year when he announced the self-employed income support scheme last year that taxes on the self-employed might rise is yet to be seen. However, what is likely is that this and future Chancellors will continue to look at this particular aspect of the tax system and wonder how they might collect a little more from the ranks of the self-employed and company owners.