The latest public sector finances reported a deficit of £31.7bn for April 2021, as COVID-related spending continued to weigh on the public finances.

Although an improvement from the £47.3bn deficit reported for the same month last year during the first lockdown, the figures are still significantly higher than the £10.6bn reported for April 2019.

The Office for National Statistics also revised the reported deficit for the year ended 31 March 2020 down by £2.8bn from £303.1bn to £300.3bn, still a peacetime record. The ONS has yet to include in the order of £27bn of bad debts on COVID-related lending in this number and estimates will be refined further over the next few months.

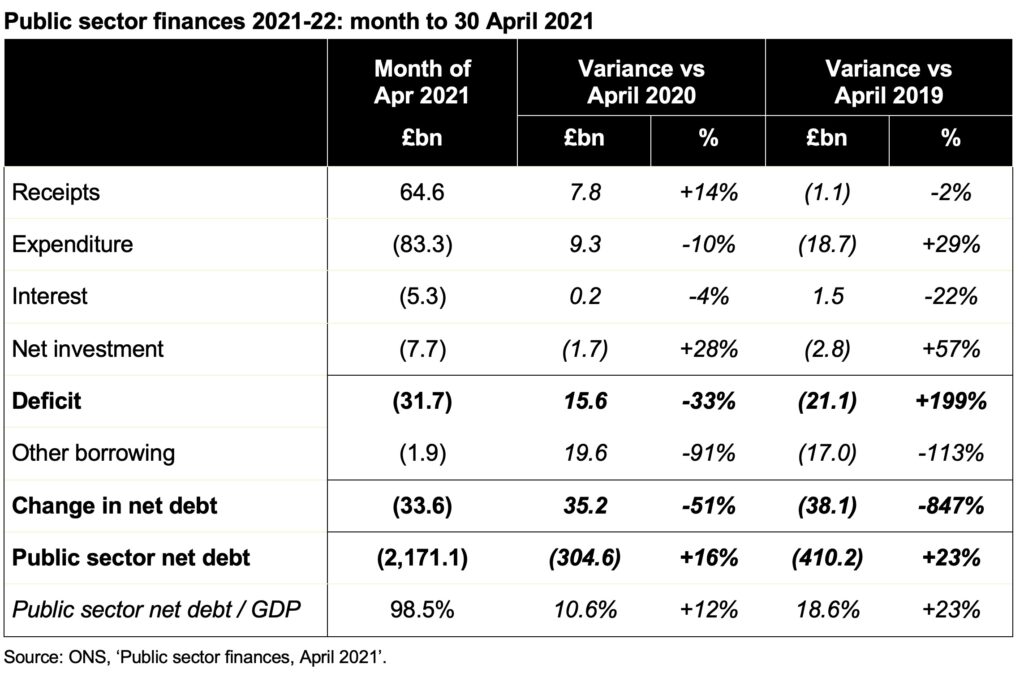

Receipts in April 2021 of £64.6bn were £7.8bn or 14% higher than a year previously, but this was still £1.1bn or 2% below the level seen a year before that in April 2019. At the same time, expenditure of £83.3bn was £9.3bn or 10% lower than April 2020, but £18.7bn or 29% higher than two years before.

Ultra-low interest rates continued to benefit the interest line, which at £5.3bn in April 2021 was £0.2bn or 4% lower than April 2020 and £1.5bn or 22% lower than April 2019.

Net public sector investment, as planned, has continued to grow with £7.7bn invested in April 2021, up £1.7bn or 28% from a year before and £2.8bn or 57% from two years ago.

This combined to produce a deficit for the first month of the 2021-22 financial year of £31.7bn, £15.6bn or 33% below that of the same month a year previously, but £21.1bn or 199% higher than April 2019.

Public sector net debt increased to £2,171.1bn or 98.5% of GDP, an increase of £33.6bn over the course of April, reflecting £1.9bn of additional borrowing over and above the deficit, principally to fund coronavirus loans to businesses and tax deferral measures. Debt is £304.6bn or 16% higher than a year earlier and £410.2bn or 23% higher than in April 2019.

The net cash outflow (the ‘public sector net cash requirement’) for the month was £34.5bn.

Commenting on the figures, ICAEW’s Public Sector Director Alison Ring said: “It is difficult to read too much into the first month’s numbers in a new financial year, but the Chancellor is likely to be relieved that the gap between receipts and spending is narrower than that seen last year during the first lockdown. But the public finances are not out of the woods, with tax receipts still below pre-pandemic levels and COVID-related spending continuing to drive up borrowing.

“The focus over the next few months is likely to be on the next Spending Review, which will decide on future public spending and investment with the long-awaited social care funding strategy now anticipated to be announced later this year. However, the need to address the long-term unsustainability of the public finances shouldn’t be forgotten.”

Caution is needed with respect to the numbers published by the ONS, which are expected to be repeatedly revised as estimates are refined and gaps in the underlying data are filled.

The ONS made a number of revisions to prior month and prior year fiscal numbers to reflect revisions to estimates and changes in methodology. These had the effect of reducing the reported fiscal deficit in the twelve months ended 31 March 2021 from £303.1bn to £300.3bn.

For further information, read the public sector finances release for April 2021.