4 March 2021: The UK economy is set to be 3% smaller than expected before the pandemic, with public sector net debt forecast to peak at 110% of GDP in 2024.

The Chancellor of the Exchequer’s second Budget on Wednesday 3 March 2021 was dominated by the coronavirus pandemic and how the economic recovery can be accelerated through stimulus measures.

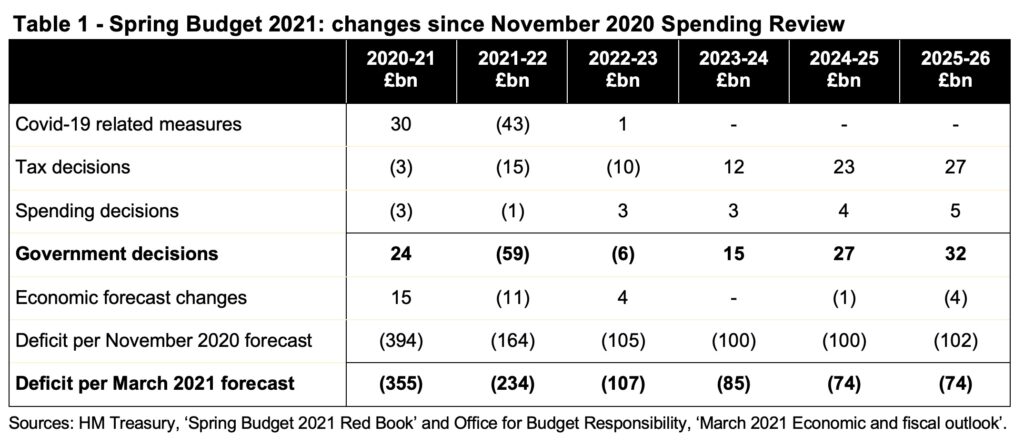

The estimated deficit for the current financial year of £355bn is now expected to be £39bn smaller than was forecast in November. This reflects a slightly better economic performance than had been anticipated, despite the extended lockdown, as well as unused contingency within the budget for COVID-19 spending.

This has been more than offset in the current budget by a continuation of support to businesses and individuals affected by the pandemic, including extending the furlough scheme, the self-employed support scheme and the Universal Credit supplement during the first half of 2021-22, together with further support to businesses, such as on business rates relief.

There were no major spending decisions, as the one-year Spending Review in November had already set departmental budgets for non-COVID-related expenditures for 2021-22, while decisions about subsequent years will be made in the three-year Comprehensive Spending Review planned for the autumn.

Tax decisions mainly comprised economic stimulus measures in 2021-22 and 2022-23, primarily the super-deduction for private sector capital expenditure that the government hopes will bring forward investment and boost the economic recovery. This is followed by tax rises over the following three years, principally from higher corporation tax on larger businesses’ profits.

The Office for Budget Responsibility’s economic forecasts remained similar to its central scenario set out in November, with the economy on track in their view to be 3% smaller than their pre-pandemic expectations. As a consequence, economic forecast changes (net of the indirect effect of government decisions) were relatively small as illustrated in Table 1.

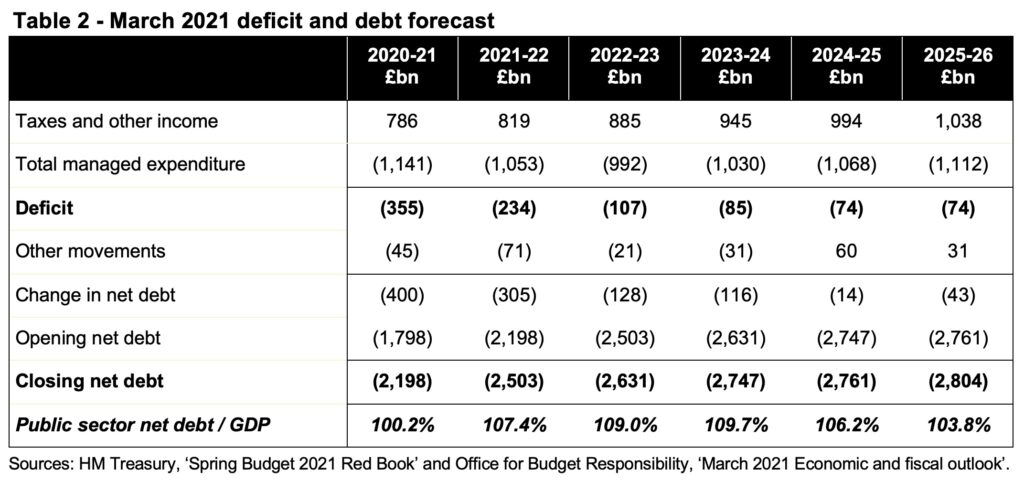

The forecast deficit for 2021-22 of £234bn is expected to be the second-largest peacetime deficit ever recorded after the current financial year, emphasising just how significant a hit the economy has suffered as a consequence of the pandemic and the restrictions on economic activity that have been necessary.

Higher corporation tax receipts are expected to reduce the deficit in the second half of the forecast period and start to stabilise the level of public debt in relation to the size of the economy. However, deficits are still expected to remain higher than pre-pandemic forecasts, with the Chancellor confirming that eliminating the deficit was no longer a government objective.

The Chancellor did not announce any new fiscal rules during his speech, although he hinted strongly they would feature targeting the deficit to be no higher than the level of public sector net investment and a stable or falling debt to GDP ratio. He stated that it made sense to use borrowing to invest while interest rates remained very low.

Although there was an indication that the Chancellor believes action is needed to deliver sustainable public finances, there was little of this action in his statement beyond the rise in the rate of corporation tax and the freezing of tax allowances from 2022-23 onwards.

Commenting on the March 2021 Budget Alison Ring, ICAEW Public Sector Director, said: “While the deficit for the current financial year will come in £39bn below what was previously expected, this is forecast to be offset by an increase to the deficit of £70bn in 2021-22. This increase reflects both the continuation of support schemes for people and businesses, as well as sizeable stimulus measures to support economic recovery.

“The additional resources being provided to HMRC to tackle fraud will be needed to provide proper scrutiny of claims for the Help To Grow and super-deduction schemes in particular.

“While the Chancellor did take action to restrain the growth in debt over the next five years, he did not fully address how he plans to deliver sustainable public finances in the longer-term. The Chancellor chose to focus on an alternative metric of ‘underlying debt’ in his speech, rather than the official measure for public sector net debt which is predicted to peak at close to 110% of GDP in 2024. Whichever measure is used, further difficult choices will be needed in future Budgets to address the fundamental challenges facing the public finances.”

For more information on the March 2021 Budget visit ICAEW’s Budget page.