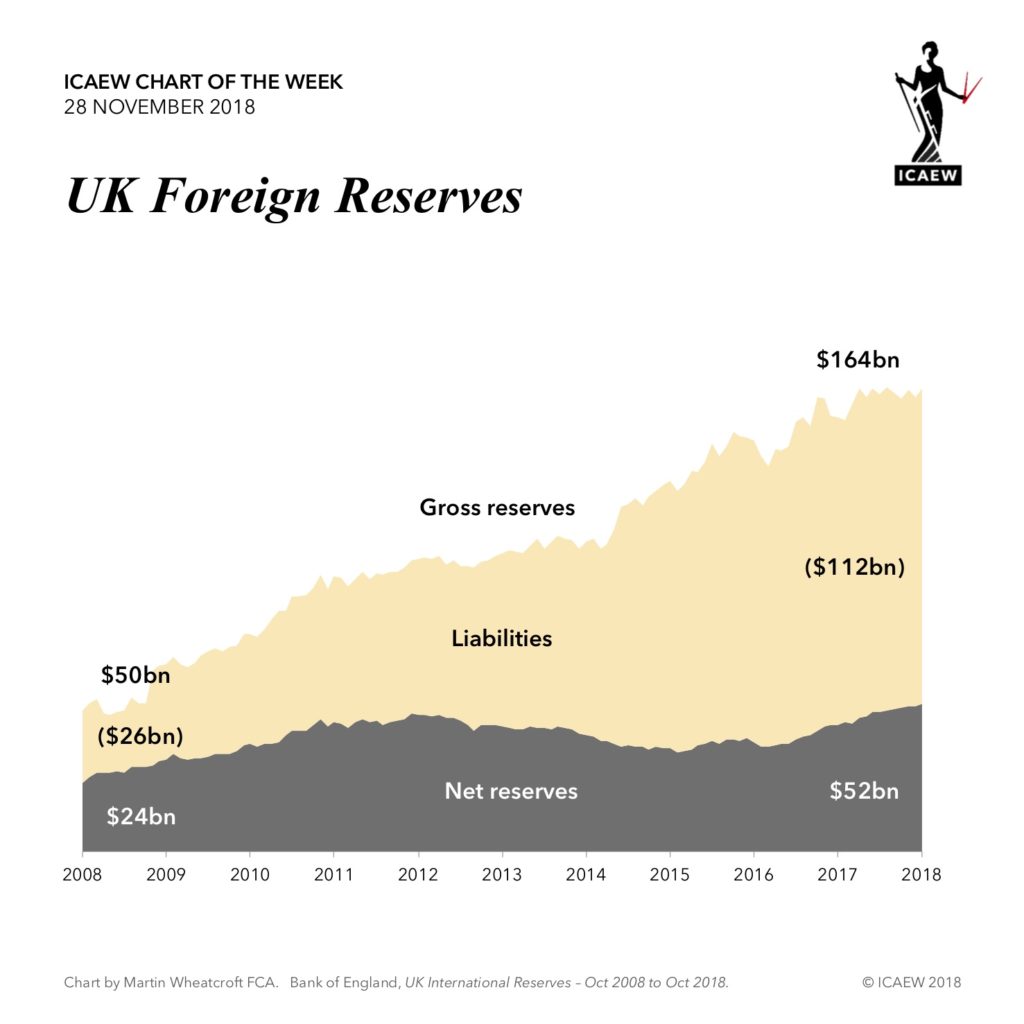

We thought we might look at one of the UK government’s key risk management tools in our chart this week – the UK’s foreign reserves.

These principally comprise financial investments in the sovereign debt of other countries, together with foreign central bank deposits, investments in the IMF, gold holdings, and foreign currency loans and deposits with UK and international banks.

As the chart shows, the UK government’s gross foreign reserves have increased from $52bn (£31bn) ten years ago to $164bn (£129bn), a 316% increase over the last decade. This is not the full story, as the government has a policy of hedging to protect against a proportion of its exposure to currency and interest rate movements.

As a consequence, derivative and other financial liabilities have also increased, meaning that net reserves have increased at a slower rate – from $24bn (£15bn) to $52bn (£41bn), a 173% increase. This is part of a deliberate strategy by the government to increase its financial firepower and so be better prepared for the next financial crisis, investing £6bn last year for example.

As the UK sails into potentially choppy economic waters over the next few years, this may prove to be quite important.

To join the conservation visit https://ion.icaew.com/talkaccountancy/b/weblog/posts/icaew-chart-of-the-week-542059546.