26 November 2020: The Office for Budget Responsibility presented its latest economic and fiscal forecasts to accompany yesterday’s Spending Review. As expected, the forecasts were far from pretty.

In its latest economic and fiscal outlook, the Office for Budget Responsibility (OBR) confirmed that economic and fiscal damage from the pandemic is severe and will have a lasting effect.

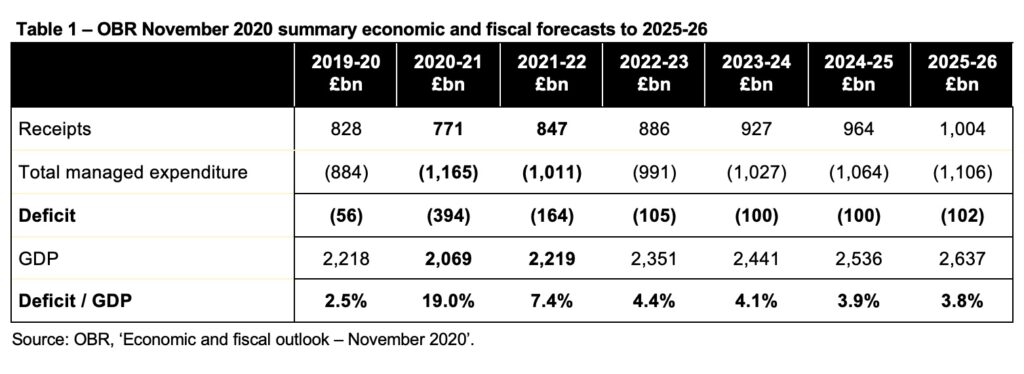

The fiscal watchdog now expects to see a sea of red ink across the first half of the coming decade: a £394bn deficit (19% of GDP) this year and the UK still running a fiscal deficit of over £100bn in five years’ time. This will be a decade after the point at which a previous Chancellor, George Osborne, hoped to have eliminated the deficit completely.

This is the highest ever fiscal deficit experienced in peacetime by the UK and reflects an additional £21bn for the cost of extending the furlough scheme across the winter and £30bn in anticipated write-offs of CBILS and other lending packages.

The fiscal pain is expected to continue into the next financial year starting on 1 April 2021, with the government planning an additional £55bn in COVID-related spending. This is offset to an extent by £10bn in lower departmental budgets, partly as a consequence of the one-year public sector pay freeze. The government says that despite this, ‘core day-to-day department spending’ is growing at 3.8% a year on average in real terms from 2019-20 to 2021-22.

Deficit to remain high for years to come

Table 1 below highlights how the deficit is forecast to be £164bn next year and to remain at over £100bn over the rest of the forecast period. This is despite GDP recovering in 2021-22 to the same level as last year (about 4% lower once inflation is taken into account) with the Chancellor hoping for strong growth to continue into 2022-23 before returning to trend after that.

The Spending Review boasts that it includes £100bn of central government capital investment in 2021-22, a £27bn real-terms increase compared with 2019-20. This reflects planned increases in previous budgets, with no new funding included in yesterday’s announcement. There are concerns about how deliverable the government’s capital investment plans are, with the OBR increasing its estimate for capital budget underspends and scaling back expectations of local authority and public corporation capital expenditure by £4bn in 2021-22 and by £3bn in subsequent years. These are both likely to reduce any positive impact that may come from the £4bn ‘levelling up fund’ announced by the Chancellor

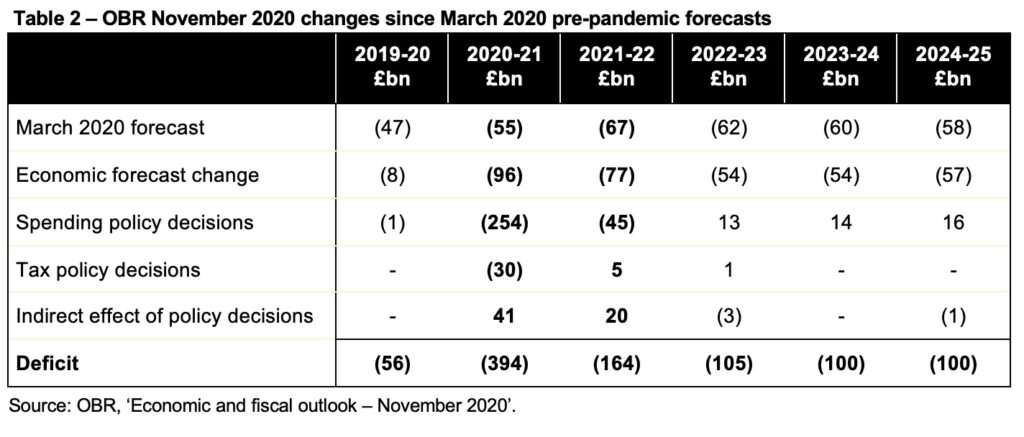

Table 2 summarises the changes between the pre-pandemic forecasts presented in the Spring Budget in March 2020 and the latest forecasts published yesterday.

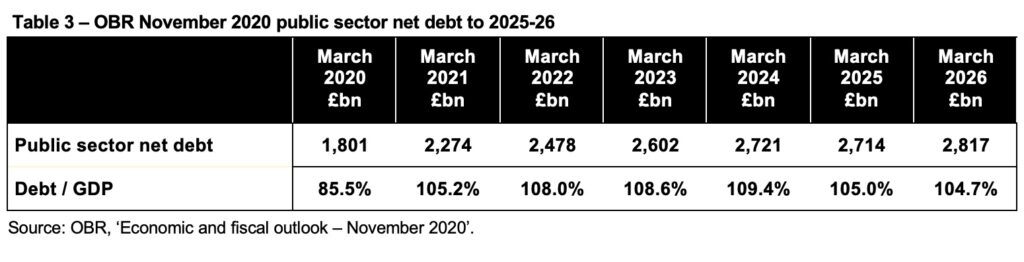

Table 3 illustrates how debt is expected to increase from £1.8tn in March 2020 to £2.3tn in March 2021 and to continue to grow to £2.8tn by March 2026, in excess of 100% of GDP throughout the next five years.

Fortunately for the government, the cost of the additional borrowing required to fund the deficit has continued to fall dramatically, with central government debt interest falling from £37bn in 2019-20 to £18bn in 2021-22, before gradually rising to £29bn in 2025-26.

Martin Wheatcroft FCA, external adviser to ICAEW on public finances, commented: “The Spending Review was pretty much as expected, with COVID-related spending extended into the next financial year and the trailed public sector pay freeze allowing the government to maintain its capital investment ambitions.

However, buried in the detail is an expectation by the OBR that it will be difficult to deliver those plans on schedule. Combined with lower capital expenditure by local government and public corporations, the hoped-for economic boost could prove elusive.

With the spending side buttoned-down for now, the focus will move to how the Chancellor plans to close the gap between receipts and spending, with the prospect of tax rises on the horizon. It is important the government takes this opportunity to develop a long-term fiscal strategy to address the long-term unsustainability of the public finances that needed addressing even before the pandemic added to the scale of the challenge.”