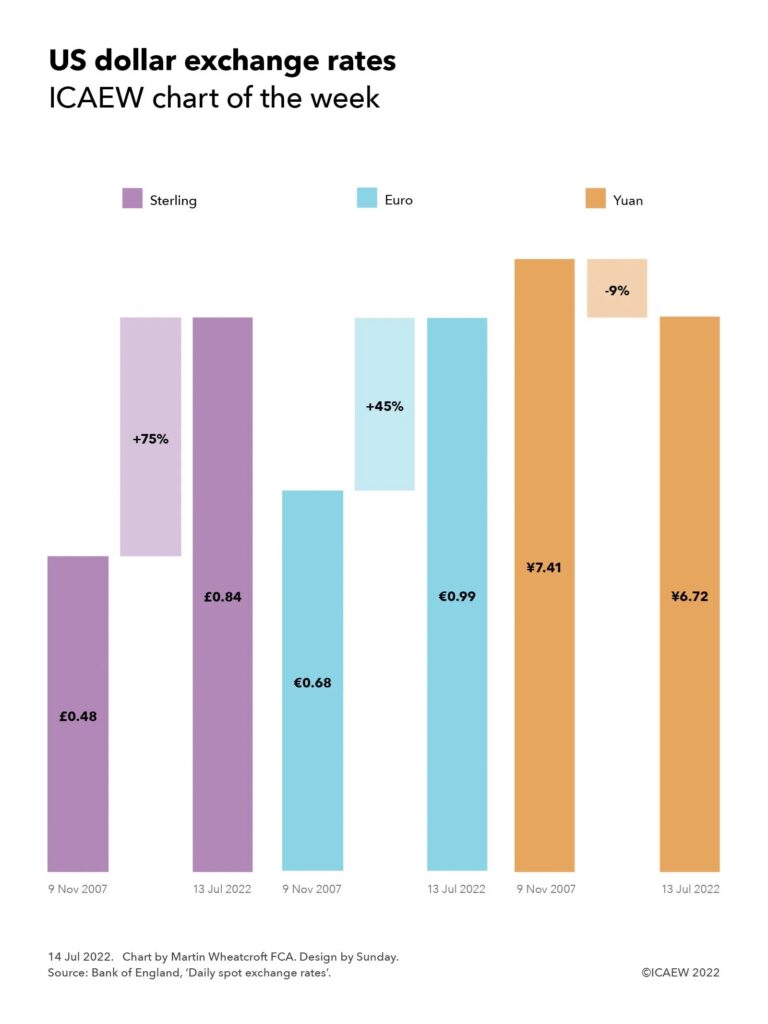

As the US dollar and euro approach parity, our chart illustrates how the US dollar has soared in value since the financial crisis compared with other major currencies apart from the Chinese yuan.

Our chart this week is on the topic of exchange rates, illustrating how the US dollar has appreciated by 75% and 45% against sterling and the euro respectively since the financial crisis, only to decline by 9% against the Chinese yuan over the same period.

On 9 November 2007, one US dollar was worth 48p as the pound peaked in value at an exchange rate of US$2.095:£1.00 according to the Bank of England’s exchange rate database. Since then the dollar has appreciated and sterling has fallen to an exchange rate of US$1.195:£1.00 at 13 July 2022, making one dollar worth 84p or 75% more today. This movement reflects a combination of much stronger economic growth in the USA over the last 15 years, higher interest rates, weaknesses in the UK economy, and the position of the US dollar as the world’s reserve currency that makes it an attractive safe haven for investors generally and even more in times of economic turmoil.

The dollar has also appreciated against the euro for similar reasons, albeit by only 45% over the same period. On 9 November 2007, one dollar was worth 68 euro cents when the exchange rate was US$1.468:€1.00, compared with the 99 euro cents it was worth on 13 July 2022 when the exchange rate was US$1.005:€1.00 – having briefly touched parity during the course of that day.

For the poor British traveller this means going to the US is substantially more expensive than it was 15 years ago, with a pound now worth just under a dollar and two dimes, compared with almost two dollars and a dime back then, a whole 90 cents less. The cost of travelling to the EU is also more expensive, with the pound worth €1.18 now compared with €1.43 in 2007, a fall of 17% in relative purchasing power.

All three currencies have depreciated against the Chinese yuan over the same period, as the Chinese economy has continued to grow to become the second largest in the world after the USA. The relative strength of the US economy has restricted the depreciation in the dollar to 9% from being worth ¥7.41 to ¥6.72 over 15 years. This contrasts with a fall of 38% in the value of the euro against the yuan from ¥10.88:€1.00 to ¥6.79:€1.00 and a 48% depreciation in sterling against the yuan from ¥15.52:£1.00 to ¥8.03:£1.00.

Exchange rates are volatile and can move significantly over the course of each minute, hour, day, week, month and year, so the numbers will keep changing. They also don’t reflect the full picture, as inflation, interest rates and economic conditions mean that the value of the dollar, pound, euro or yuan in your pocket will be worth more or less depending on what you want to use it for.

The strengthening of the US dollar over the last 15 years is one of the key elements of the global economic story that has seen the US economy come through the financial crisis and the pandemic in better shape than almost every other developed country. Many commentators believe that this is likely to continue in the near term, especially as Europe is much more directly affected by the Russian invasion of Ukraine.

However, as all professional financial advisers will tell you, past performance is no guide to the future – and your guess about how much one US dollar might be worth in the next fifteen years is likely to be as good as anyone’s.