This week we look at the Spring Statement, where the story is all about inflation as the Chancellor responded to the pressures that have contributed to the cost of living crisis.

What Chancellor Rishi Sunak had originally hoped would be a short report to Parliament on the latest economic and fiscal forecasts turned into a fully-fledged fiscal event as he responded to a ‘cost of living’ crisis that is expected to put severe pressure on household budgets and is risking the viability of many businesses. The Office for Budget Responsibility (OBR) estimates that the Chancellor’s energy support package and tax cuts will cover around a third of the decline in living standards expected in the coming financial year.

Inflation is now centre stage in a way that it hasn’t been since the 1970s.

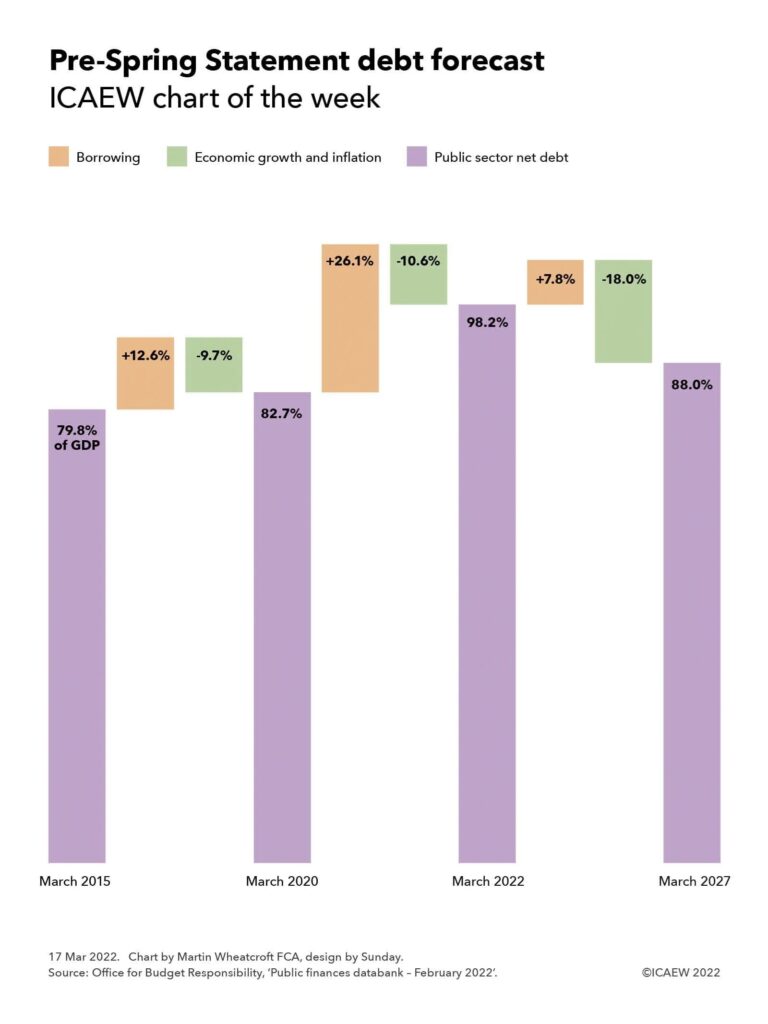

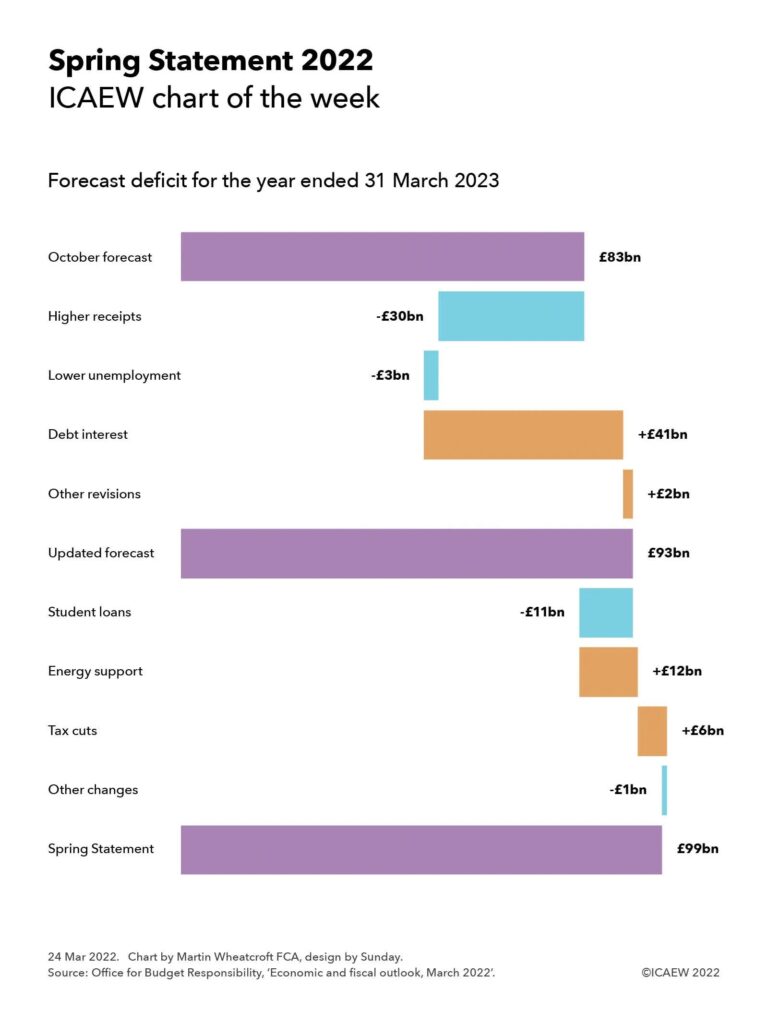

Our chart summarises the changes in the forecast for fiscal deficit the coming financial year commencing on 1 April 2022, showing how last October’s forecast of a £83bn shortfall between receipts and expenditure has increased to a £99bn shortfall in the latest forecasts by the OBR.

The good news is that the economic recovery from the pandemic has been stronger than previously thought, with the pandemic support measures such as the furlough scheme being rewarded with stronger tax receipts coming through into the forecasts. An extra £30bn is expected in 2022/23, complemented by lower unemployment than expected, which also reduces the forecast for welfare spending by an estimated £3bn.

Offsetting that is a huge rise in interest costs. This is driven by a sharp rise in the retail prices index (RPI), to which a substantial proportion of the government’s debt is linked, combined with higher interest rates as the Bank of England attempts to prevent inflation rising even further. These factors add an extra £41bn to the forecast interest bill for next year, bringing it up to £83bn, three and a half times the £24bn in 2020/21 and more than 50% higher than the £54bn now expected for the current financial year. Interest in subsequential financial years has been revised up by around £9bn a year on the basis (the forecasters hope) that inflation is brought back under control in 2023/24.

Other changes to the fiscal forecast add £2bn to the deficit forecast, bringing it up to £93bn before taking account of policy decisions announced since last October. The first, which for some reason was not highlighted by the Chancellor in his speech, was the impact of increasing the amounts that graduates will have to repay on their student loans, reducing the anticipated bad debt write-off in 2022/23 by £11bn from the estimate made last October.

The Chancellor did talk about the energy support package that he announced last month as the energy prices rises coming in April were announced. However, he did not add to that package directly – instead choosing to announce tax cuts of about £6bn in 2022/23. The main element is an increase from July of around £3,000 in the threshold at which National Insurance is payable by employees, which will benefit many low to middle income families, but not (as the Institute for Fiscal Studies, the Resolution Foundation and others have pointed out) the very poorest that will be hit hardest by price rises. More than two thirds of the benefit will go to higher income households.

Overall, the OBR says the energy support package and tax cuts together will offset around a third of the fall in living standards that is expected in the coming year.

Other policy changes amounting to around £1bn were offset by indirect effects of £2bn, resulting in a net £1bn benefit to bring the forecast deficit to £99bn, some £16bn higher in total than that predicted in October.

These numbers don’t include the 1p cut in the basic rate of income tax from 6 April 2024 that was also announced by the Chancellor. This is expected to cost around £6bn a year in lower tax receipts, but is expected to be more than offset by the effect of freezing both income tax and national insurance thresholds (expected to bring in somewhere in the region of £18bn extra a year). In effect, the Chancellor has chosen to bank the ‘benefit’ of higher inflation on his decision to freeze thresholds.

The big question is whether the Chancellor will be able to hold off from providing further support to households and businesses for the rest of the financial year. Most commentators appear to suggest that it is likely that he will return to the despatch box in the House of Commons before the next round of energy prices rises in October in order to make further announcements.