The UK reported a £19.1bn fiscal deficit in February 2021, bringing the total shortfall over eleven months to £278.8bn. Public sector net debt is up by £333.0bn at £2.13tn.

The latest public sector finances released on Friday 19 March reported a deficit of £19.1bn for February 2021, as COVID-related spending continued to weigh on the public finances. This brought the cumulative deficit for the first eleven months of the financial year to £278.8bn, £228.2bn more than the £50.6bn reported for the same period last year.

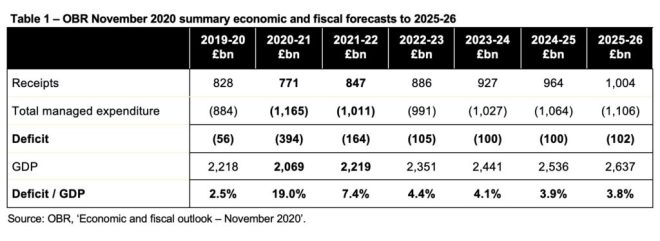

The reported deficit for the eleven months excludes £27.2bn in potential business loan write-offs that the Office for Budget Responsibility (OBR) has included in its forecast deficit of £354.6bn for the full financial year.

Falls in VAT, corporation tax and income tax receipts and the waiver of business rates were the principal driver of lower tax revenues over the last eleven months, while large-scale fiscal interventions have resulted in much higher levels of expenditure. Net investment is greater than last year (mostly as planned), while the interest line has benefited from ultra-low interest rates.

Public sector net debt increased to £2,131.2bn or 97.5% of GDP, an increase of £333.0bn from the start of the financial year and £347.2bn higher than in February 2020. This reflects £54.2bn of additional borrowing over and above the deficit, much of which has been used to fund coronavirus loans to businesses and tax deferral measures.

The cash outflow (the ‘public sector net cash requirement’) for the month was £11.4bn, increasing the cumulative total cash outflow this financial year to £322.3bn. This is a significant swing from the cumulative net cash inflow of £10.9bn reported for the equivalent eleven-month period in 2019-20.

The combination of receipts down 5%, expenditure up 27% and net investment up 21% has resulted in a deficit for the eleven months to February 2021 that is around five times as much as the budgeted deficit of £55bn for the whole of the 2020-21 financial year set in the Spring Budget in March, despite interest charges being lower by 27%.

Alison Ring, ICAEW Public Sector Director said: “Today’s numbers are in line with expectations, with the deficit for the past 11 months reaching £278.8bn. This means we are on track for public sector net borrowing to exceed £300bn for the full year once a potential £27bn in bad debts that have not yet been recorded are factored in.

“Our eyes are now focused on what possible tax measures, in addition to the planned corporation tax rise, the government might use to start rebuilding the public finances.”

Caution is needed with respect to the numbers published by the ONS, which are expected to be repeatedly revised as estimates are refined and gaps in the underlying data are filled.

The ONS made a number of revisions to prior month and prior year fiscal numbers to reflect revisions to estimates and changes in methodology. These had the effect of reducing the reported fiscal deficit in the first ten months from £270.6bn to £259.7bn and increasing the reported deficit for 2019-20 from £57.1bn to £57.7bn.