15 April 2020: a report from the Office for Budget Responsibility (OBR) indicates that the fiscal deficit could increase to £273bn in 2020-21, but it cautions that this is only one of many plausible scenarios.

The OBR has produced its first analysis of the potential economic and fiscal impact of the coronavirus, based on a three-month lockdown followed by restrictions for a further three months.

At the same time, the International Monetary Fund has warned that the global economic contraction underway is likely to be the worst since the Great Depression, dwarfing the financial crisis twelve years ago.

In its ‘coronavirus reference scenario’, the OBR indicates that the UK economy could fall by 35% in the second quarter of 2020, before bouncing back to leave the economy 13% smaller in 2020 than in 2019.

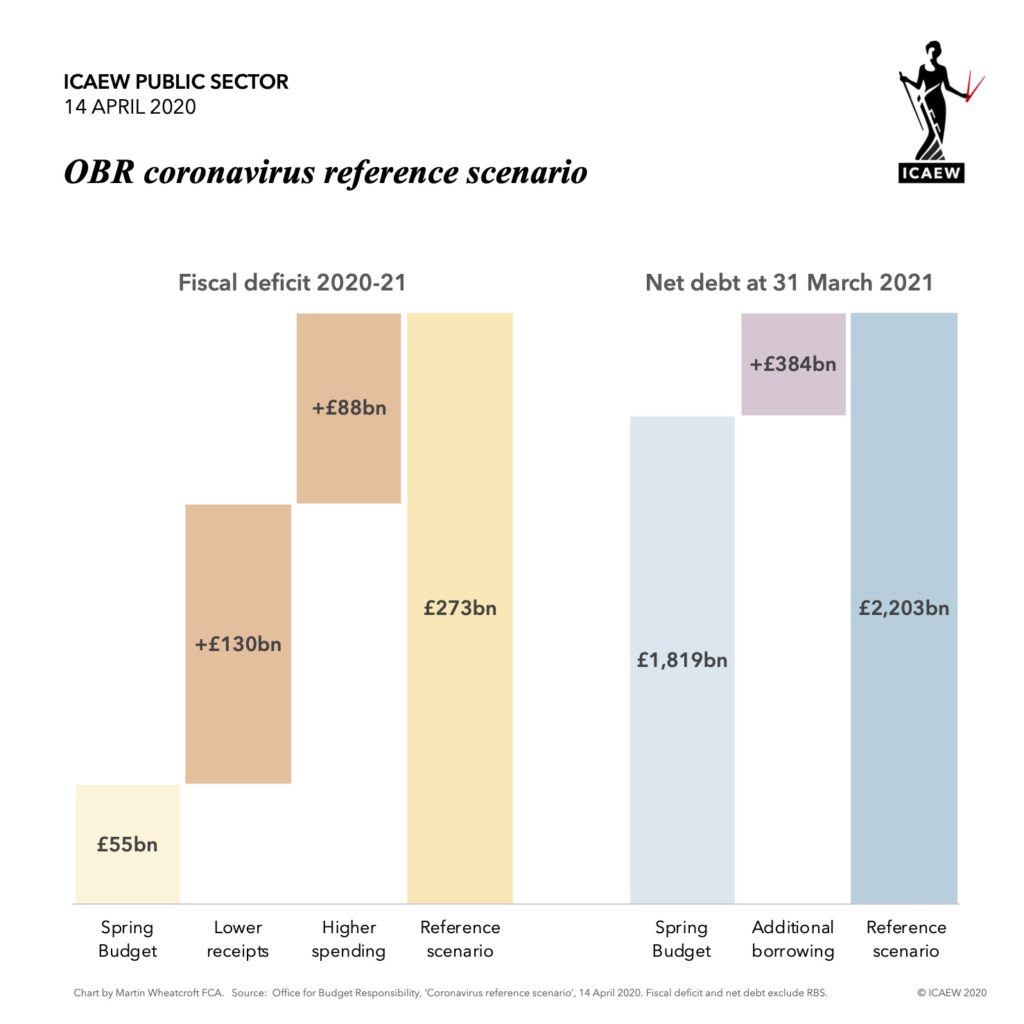

The consequence would be an increase in the deficit for the fiscal year ending 31 March 2021 to £273bn or 14% of GDP, while public sector net debt could be £384bn higher than budgeted for, reaching £2.2tn or 95% of GDP by the end of the fiscal year.

The OBR says that the economic impact of the coronavirus will derive much less from people falling ill or dying, than from the public health restrictions and social distancing required to limit its spread, severely reducing demand and supply at the same time. That means lower incomes, less spending and weaker asset prices, all of which reduce tax revenues, while job losses will raise public spending.

Once the crisis has passed and policy interventions have unwound, the OBR thinks that annual borrowing could return to roughly the Spring Budget 2020 forecast. However, net debt would continue to be much higher, potentially £260bn (10% of GDP) more than the baseline forecast by 31 March 2025.

The OBR analysis assumes that increased public spending, tax cuts and holidays, loans and guarantees, and actions taken by the Bank of England, designed to support household incomes and to limit business failures and layoffs, will help prevent greater economic and fiscal damage in the long term. However, it warns that the longer the disruption lasts, the more likely it is that the economy’s future potential output will be ‘scarred’ with adverse consequences for future deficits and for fiscal policy.

The International Monetary Fund (IMF) now predicts that the global economy will contract by 3.0% in 2020, much worse than the 0.1% contraction seen during the financial crisis in 2009 and a cut of 6.3% from its previous prediction in January. The IMF prediction is based on a shallower, but longer recession than the OBR’s scenario for the UK. Overall, the IMF believes that the cumulative output loss in 2020 and 2021 from the pandemic could be as much as $9tn.

Alison Ring, Director, Public Sector for ICAEW, commented: “The analysis published by the OBR is not a forecast, but the scenario it presents is pretty startling; making clear that whatever actually happens, the damage to public finances from the coronavirus pandemic will be extremely severe.

“While the OBR suggests that the economy and tax receipts could recover relatively quickly, the additional debt burden will weigh on the public finances for many years for come.”