Gordon Brown’s constitutional commission calls for greater fiscal devolution, going much further than the government’s gradual rollout of levelling-up devolution deals.

There appears to be a growing belief among policymakers across the political spectrum that regional and local authorities need greater financial powers if economic outcomes are to be improved across the UK. However, while there appears to be some consensus around extending the fiscal powers of the devolved administrations in Wales, Scotland and Northern Ireland, there is much less agreement on how far to go in devolving financial powers for the 84% of the UK’s population that live in England.

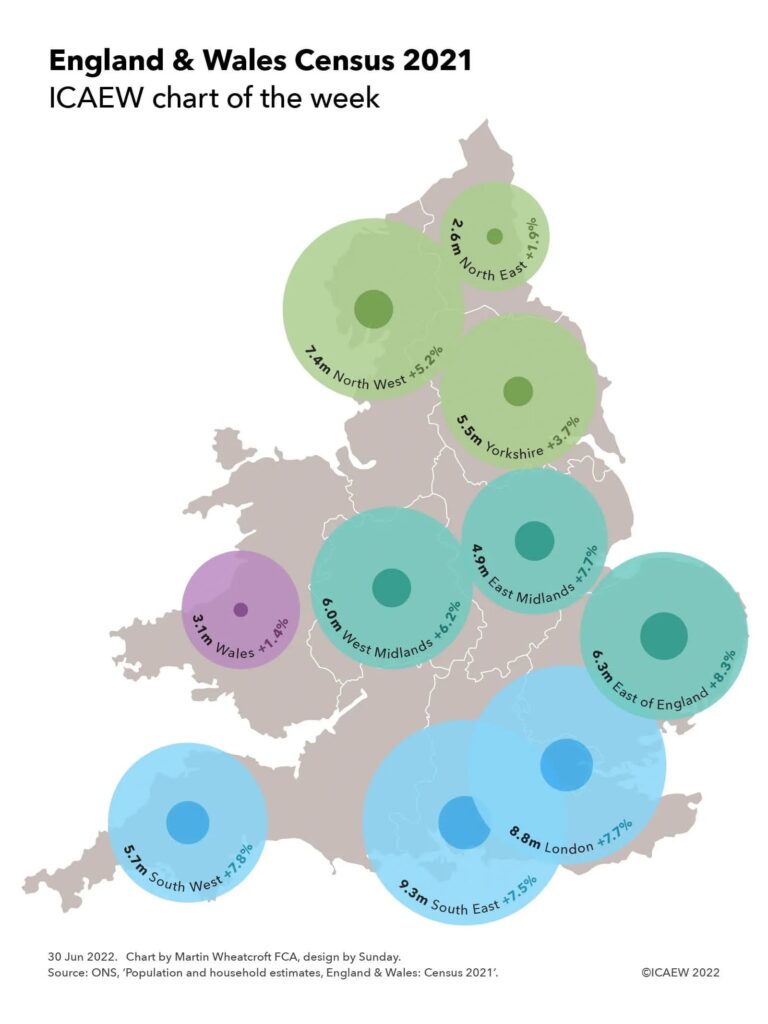

Levelling-up ‘devolution deals’ cover almost half of England

The government has adopted a gradualist approach to fiscal devolution that has principally revolved around ‘devolution deals’, part of its wider Levelling Up agenda to spread prosperity across England outside London and the South East. These deals generally provide an agreed stream of investment funding over several decades, greater control over the adult education and transport budgets, and some additional powers (eg, over second homes in Cornwall), in exchange for agreeing to direct elections for combined authority mayors or county leaders.

Regional devolution deals were announced in 2022 for the North East, York and North Yorkshire, and the East Midlands, together with county devolution deals for Suffolk, Norfolk and Cornwall. The government is also working on ‘trailblazer’ devolution deals along similar lines with existing city-regions, starting with Greater Manchester and the West Midlands combined authorities.

The devolution deals do not provide any additional tax-raising powers for regional combined authorities or local authorities, and the majority of local government funding in England continues to be determined by central government. It is also unclear whether the government will attempt to extend the coverage of devolution deals across the rest of England beyond the existing areas covered and the Devon and East Yorkshire deals that are still being negotiated.

Gordon Brown constitutional commission

The Labour Party has also been thinking about devolution as part of a wider debate on the UK constitution, with a review led by former Prime Minister Gordon Brown into the UK’s constitution. While many of the headlines about the review focused on reform of the House of Lords, most of the report focused on devolution and intergovernmental cooperation, including the role played by English regions. This included recommending greater long-term financial certainty and new fiscal powers for local government in England, in addition to deepening the devolution settlements in Scotland, Wales and Northern Ireland.

Several of the Gordon Brown commission’s proposals align with recommendations made by ICAEW to HM Treasury at the time of the last Spending Review. ICAEW called for stable funding for local authorities, rationalisation of funding streams, investment in fiscal resilience and strengthening financial management.

At the same time as advocating for greater fiscal flexibility for local government, the review stresses the need for scrutiny and accountability to ensure money is spent wisely. One option might be for the proposed Office for Value for Money to expand to cover local government, further developing the ideas put forward in a Fabian Society report, Prizing the Public Pound, produced in collaboration with ICAEW. Other ideas include the piloting of local public accounts committees.

Although clear in the reforms to the UK’s constitutional arrangements that the review would like to see, the report lacks detail on how it intends to achieve its proposals – for example in identifying individual taxes that could be devolved to regional and local authorities.

The report is ambitious in aiming to implement reforms within just one parliamentary term, meaning there will be a lot of work and consultation required to design the new arrangements, establish public support and then develop and pass the necessary legislation.

Fabian Society-ICAEW round table

A joint Fabian Society-ICAEW round table last year explored some of the practical challenges involved in devolving fiscal powers to regional and local government in England. The group, which included members and contributors to the Gordon Brown commission, looked at the proposed trailblazer deals being negotiated by Greater Manchester and the West Midlands combined authorities, as well as existing ideas that have been put forward for devolved taxes, such as on tourism.

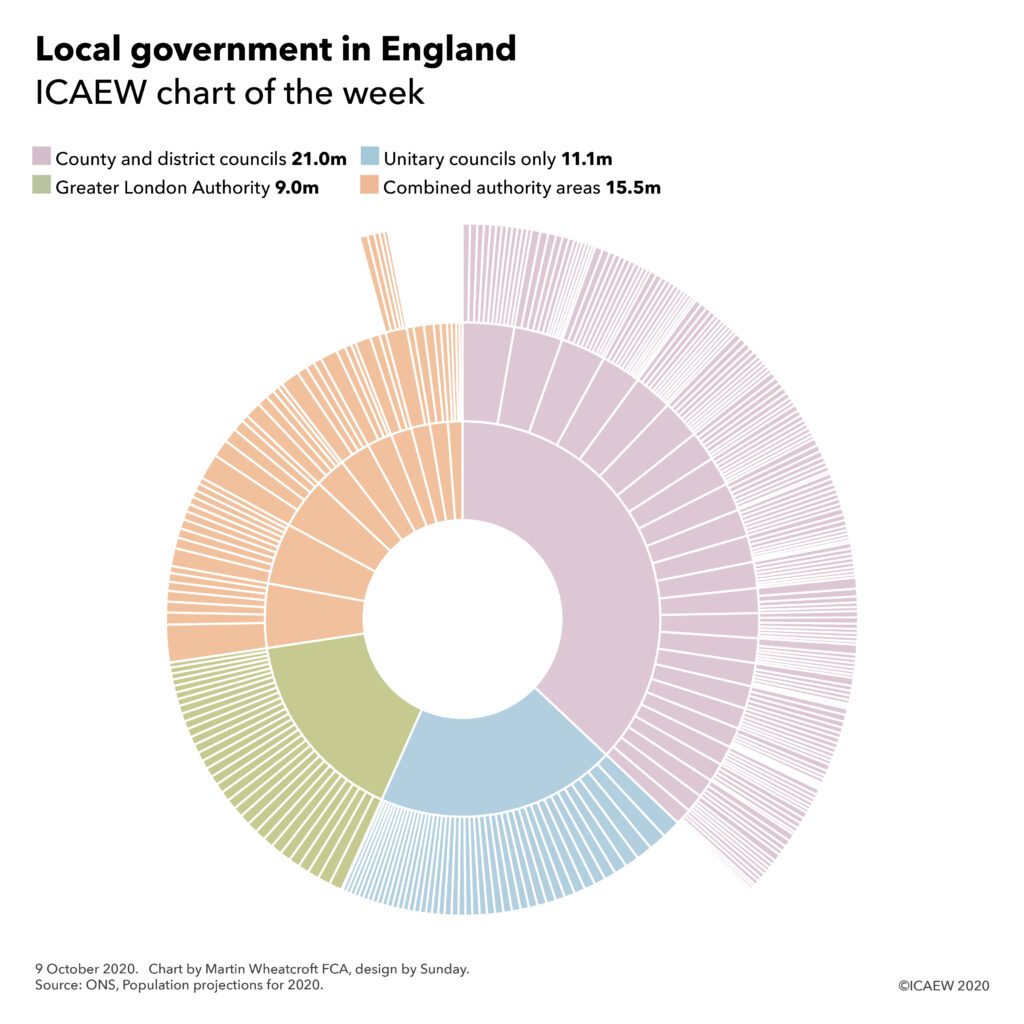

The participants discussed how existing disparities in tax bases between different parts of the country meant some form of redistribution or central government funding was still likely to be needed, as illustrated by the cities of Westminster and Hull that each serve populations of around 250,000 or so, but which have very different levels of prosperity and hence local tax capacity.

The approach adopted in Germany of shared national taxes was also discussed, a key element in how regional governments (Länder) are funded. This is further explored in a separate Fabian Society report: Levelling Up? Lessons from Germany.

While there were a variety of views around the funding mechanisms that could be used to pay for local public services, there was general agreement on the need to rationalise funding streams, for long-term funding certainty to enable local authorities to plan ahead, and an end to the process of submitting multiple bids to central government for incremental funding.

Martin Wheatcroft FCA, external adviser on public finances to ICAEW, commented: “While there appears to be an emerging political consensus on the need to devolve much greater fiscal powers to regional and local tiers of government in England, the proposals so far have been relatively limited in their ambition.

“This may be because national politicians find it difficult to let go of the purse strings, but it is also the case that delivering fiscal devolution is not that easy in practice. Economic disparities between different places mean that needs are often greater in areas with less in the way of tax-generating ability, while redistributive mechanisms are challenging to design in a way that all parties deem to be fair. This is not helped by a patchwork quilt of differing regional and local government structures that would make it difficult to implement a single standardised model for funding local public services across England.”