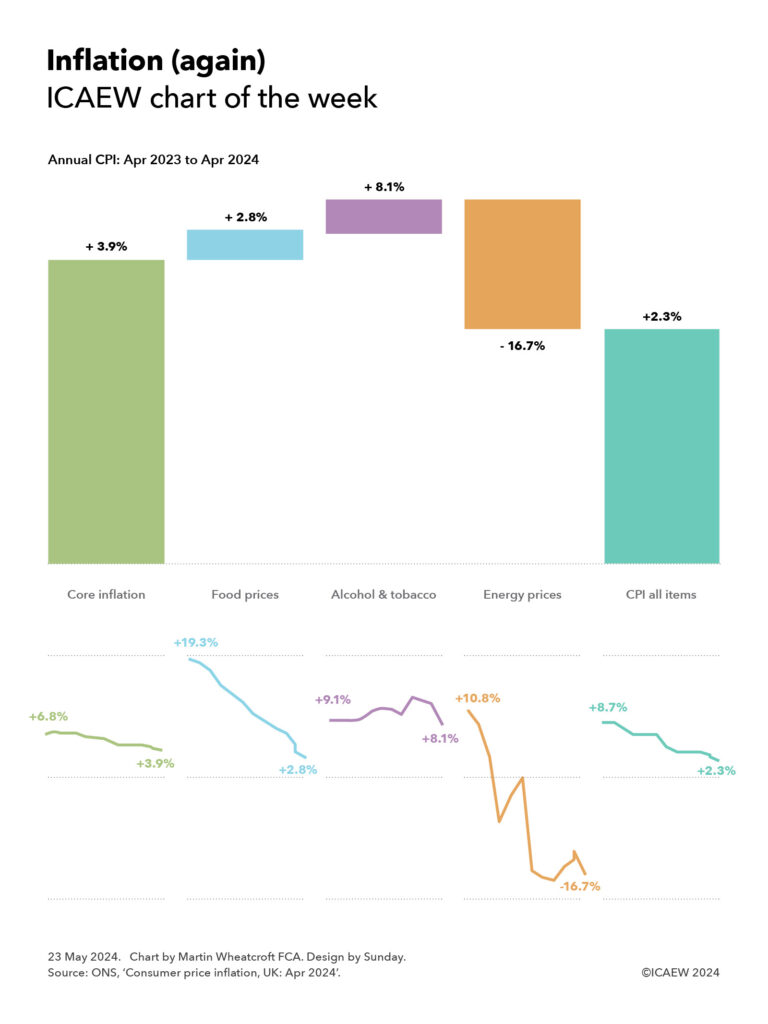

My chart for ICAEW this week shows that while headline inflation slowed to 2.3% in April, a core inflation figure of 3.9% means the fight against inflation is far from over.

We return to the topic of consumer price inflation (CPI) this week following the news that it has returned to within its target range of 2% plus or minus 1% for the first time since July 2021.

Our chart illustrates how a 16.7% fall in energy prices between April 2023 and April 2024, have partially offset core inflation of 3.9%, food price rises of 2.8% and alcohol and tobacco prices rises of 8.1%, to result in annual CPI of 2.3%.

It also shows how each of these components of inflation have changed over the last 12 months. Core inflation has slowed from an annual rate of 6.8% in April 2023 to 3.9% in April 2024, food price inflation from 19.3% to 2.8%, and alcohol and tobacco price inflation from 9.1% to 8.1%. Meanwhile, energy prices have fallen over the last year with the annual rate of change going from +10.8% in April 2023 to -16.7% in April 2024.

These components of the inflation index combine to see CPI slow from an annual rate of 8.7% in April 2023 to 2.3% for the 12 months to April 2024, positive news for the Bank of England. It has spent the last few years writing letters to the Chancellor, explaining why inflation is off target and the actions the Bank is taking to bring inflation back on target.

The challenge for the Bank of England’s Monetary Policy Committee is when to take the foot off the brake and start cutting interest rates. The indications are that this won’t be in June as some had hoped, with policymakers concerned about the persistence of services inflation (5.9% in the year to April 2024, a component of core inflation not shown in the chart) and the level of wage rises (5.7% in the year to March 2024), neither of which are consistent with inflation staying within its target range.