This week’s chart illustrates how railway strikes are not the only problem facing Great British Railways, the new publicly owned body being established to run the rail network from next April.

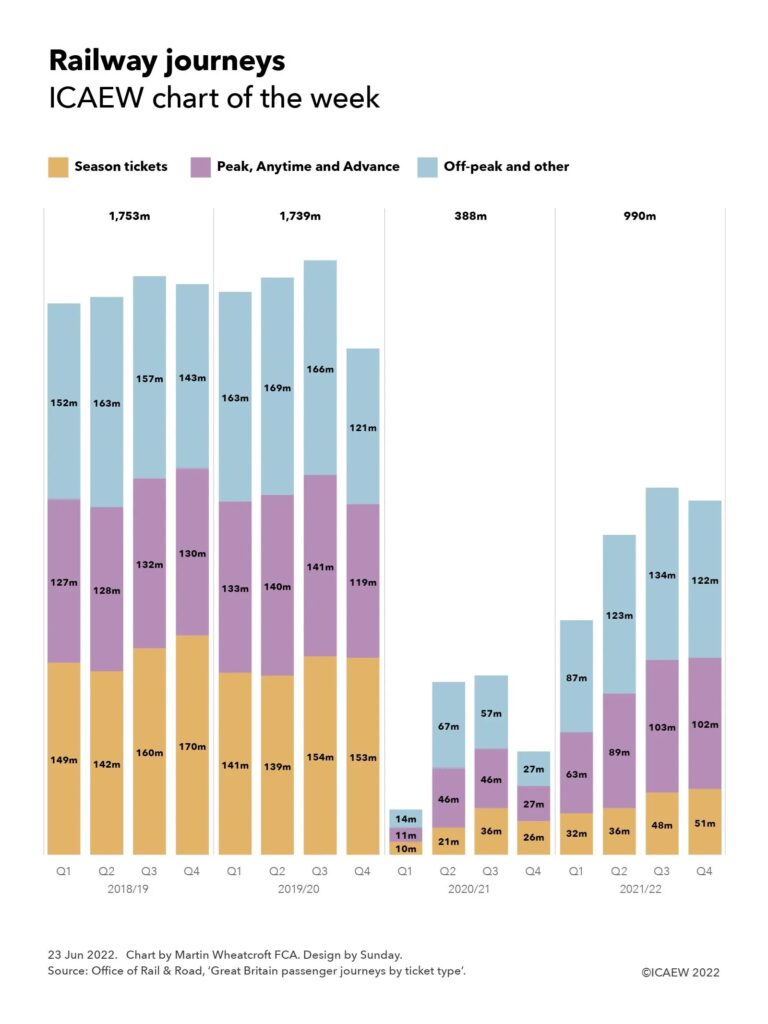

The ICAEW chart of the week is on railway journeys in Great Britain over the past four financial years, highlighting how the number of trips on the network have fallen from a peak of 1,753m in 2018/19 to 1,739m in 2019/20 and 388m in 2020/21, before increasing to 990m in the most recent financial year ended 31 March 2022. These numbers exclude London Underground and light rail and tram systems in London and elsewhere, but they include London Overground.

Passenger numbers are well below pre-pandemic levels – a challenge with a government increasingly reluctant to plug the gap in passenger revenues with additional subsidies on an ongoing basis.

The biggest fall has been in trips using Season tickets, which at 51m during January through March 2022 were 70% below the 170m reported for the fourth quarter of 2018/19. Trips using Peak, Anytime and Advance tickets and Off-peak and other tickets in Q4 of 2021/22 were 22% and 15% down on the quarter ended 31 March 2019. The chart illustrates how travel patterns have changed as many more people work from home on a regular basis, especially regular commuters who have traditionally formed the backbone of rail passenger traffic.

These falls in usage – and in the associated revenue from ticket sales and other income – are likely to present a huge challenge for Great British Railways, the new public body scheduled to take over the running of the railways in England, Wales and Scotland from 1 April 2023 (not including Transport for London and light rail and tram systems).

Great British Railways is taking on responsibility for the track and stations currently owned by Network Rail and for the running of train services too – with the train operating companies engaged to run services on its behalf under concession arrangements that expose the taxpayer to revenue risk. A difficult enough task at the best of times, but one made even more challenging by the consequences of the pandemic and with a shareholder in the form of a government keen to cut subsidies that have ballooned since the start of the pandemic.

As the chart shows, trips using Season tickets by quarter were 149m, 142m, 160m and 170m in 2018/19; 141m, 139m, 154m and 153m in 2019/20; 10m, 21m, 36m and 26m in 2020/21; and 32m, 36m, 48m and 51m in 2021/22. Trips using Peak, Anytime and Advance tickets were 127m, 128m, 132m and 130m in 2018/19; 133m, 140m, 141m and 119m in 2019/20; 11m, 46m, 46m and 27m in 2020/21; and 63m, 89m, 103m and 102m during 2021/22. Trips using Off-peak and other tickets were 152m, 163m, 157m and 143m in 2018/19; 163m, 169m, 166m and 121m in 2019/20; 14m, 67m, 57m and 27m in 2020/21; and 87m, 123m, 134m and 122m in 2021/22.

The recent strikes won’t help, especially if they recur over the summer. However, whatever happens, getting people back to using the railways is going to be a big task for the new team at Great British Railways – whether by persuading workers to return to the office, encouraging people out of their cars or by just enticing us all to let the train take the strain more often than we do at the moment.