16 November 2020: Alison Ring, ICAEW’s director for public sector, has written to the Chief Secretary to the Treasury ahead of the Spending Review to stress the importance of investment in infrastructure, data and financial management.

The government has announced that the Spending Review will take place on 25 November 2020 but with the uncertainties caused by coronavirus, it has decided to restrict this to only one year instead of the previously planned three-year time horizon.

In the letter to Steve Barclay MP, Chief Secretary to the Treasury, ICAEW stresses how vital it is the government moves forward with its ambitious programme of infrastructure investment, and that projects are not delayed by the postponement of the Budget until next year and the reduction of the scope of the Spending Review to one year.

Commenting on the letter Alison Ring OBE FCA, ICAEW’s director for public sector said: “The 2020 Spending Review comes at a critical time for the UK and its public finances and will quite rightly focus on the government’s current spending plans for the coming financial year starting in April 2021 and capital budgets for the following year. Well-targeted support will be critical to ensure as strong a recovery from the coronavirus pandemic as possible.

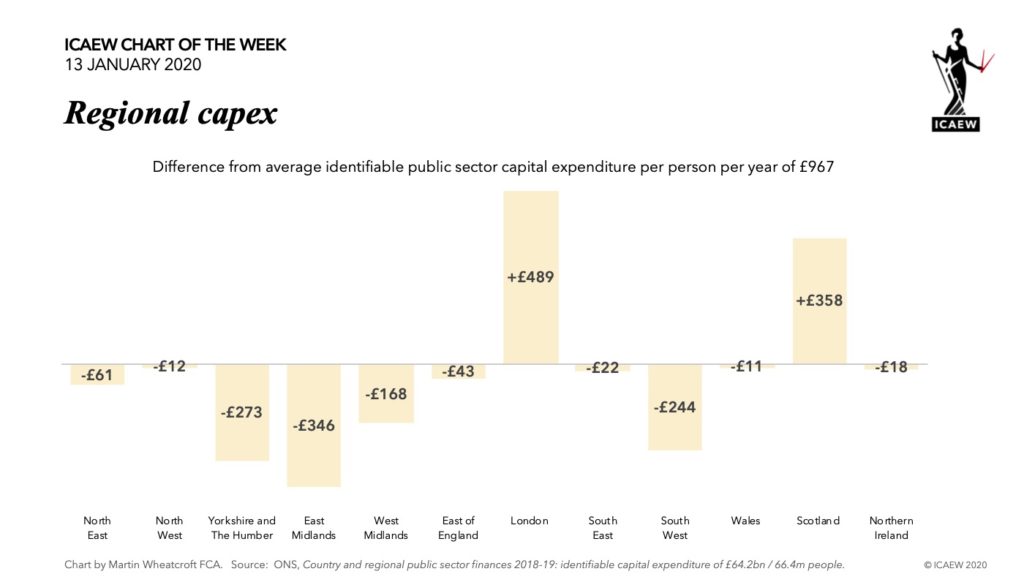

Our letter to the Chief Secretary focuses on the importance of budgetary certainty to ensure infrastructure projects are green-lit now rather than risking further delays because of the restriction in Spending Review time horizon. The long-delayed National Infrastructure Strategy is urgently needed if the government’s ambitions to level up economic prosperity and deliver carbon neutrality are to be achievable.

The government also has ambitious plans to improve the way government works, with the recently published National Data Strategy setting out how digital innovation will be key. We comment in the letter how the importance of high-quality financial skills, finance processes and risk management to delivering better outcomes and ensuring value for money for taxpayers should not be underestimated. The government does not have the best of records in undertaking major transformation programmes, and we caution the Chief Secretary against under-resourcing the planning stages of these projects.

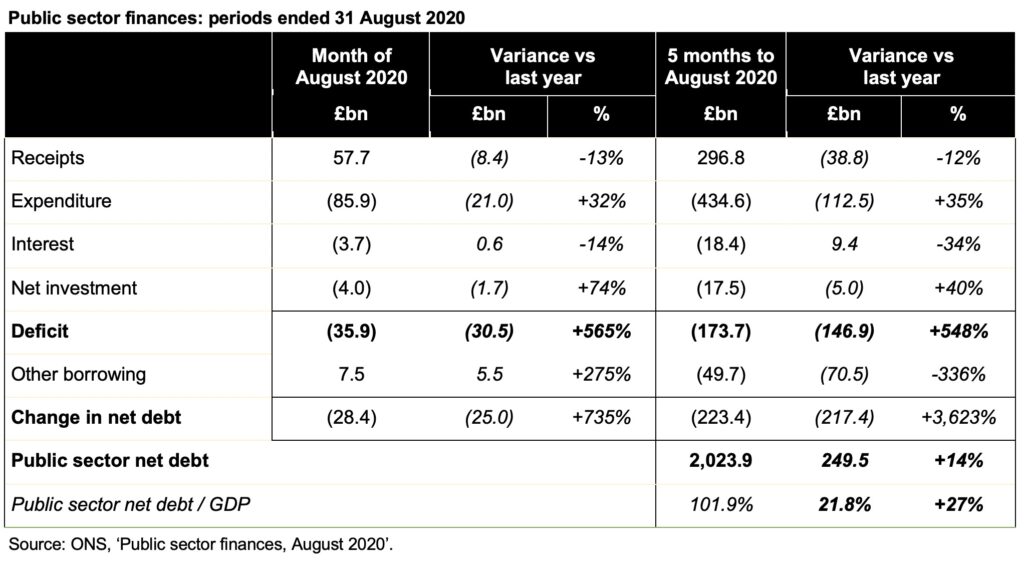

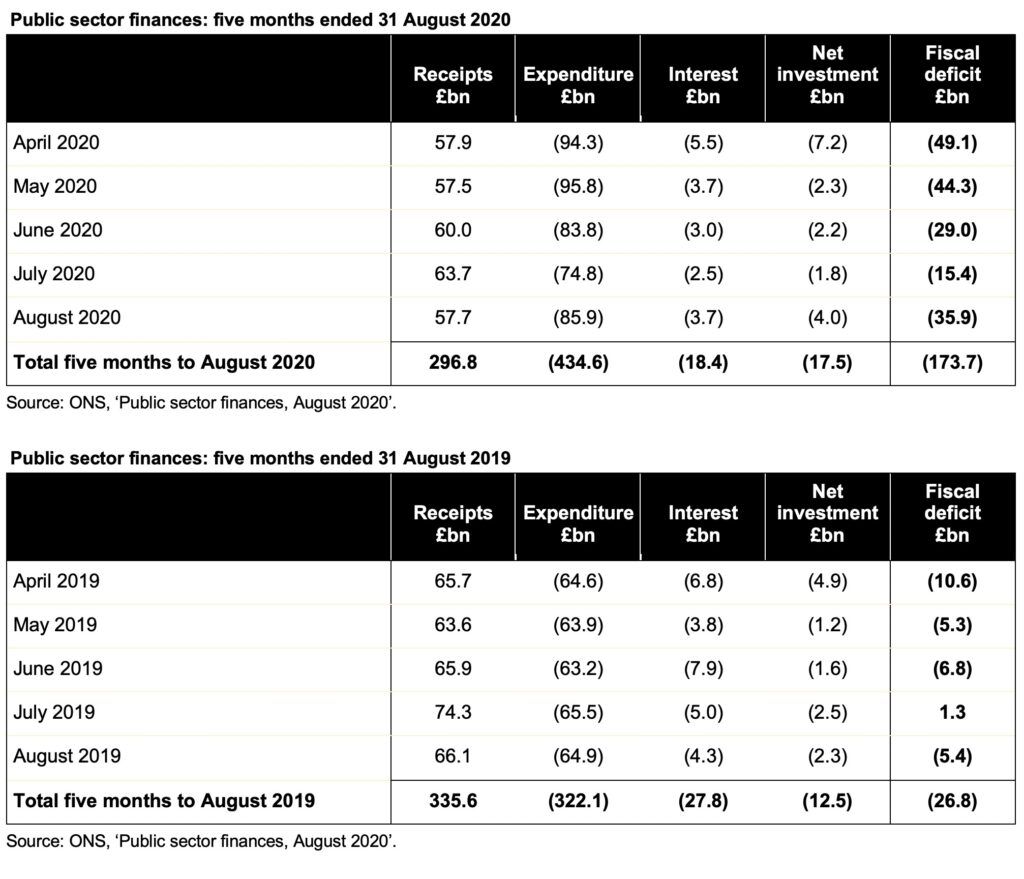

Finally, we hope that the government will use the delays in the Budget and the later years of the Spending Review to think about the longer term and how to put the public finances on a sustainable path. Even before the pandemic and the huge amounts of additional borrowing being undertaken this year, the Office for Budget Responsibility had reported that the strains on public services, more people living longer, and growing debts and other public liabilities were not being addressed. A comprehensive long-term fiscal strategy is needed to look beyond the immediate and establish a sustainable framework for the public finances for the next quarter of a century.”

The letter to the Chief Secretary to the Treasury focuses on three key areas, all of which ICAEW believes are essential to re-balancing economic opportunity and performance across the UK and to achieving carbon neutrality, as well as being key to driving the post-pandemic economic recovery in 2021 and the decade ahead.

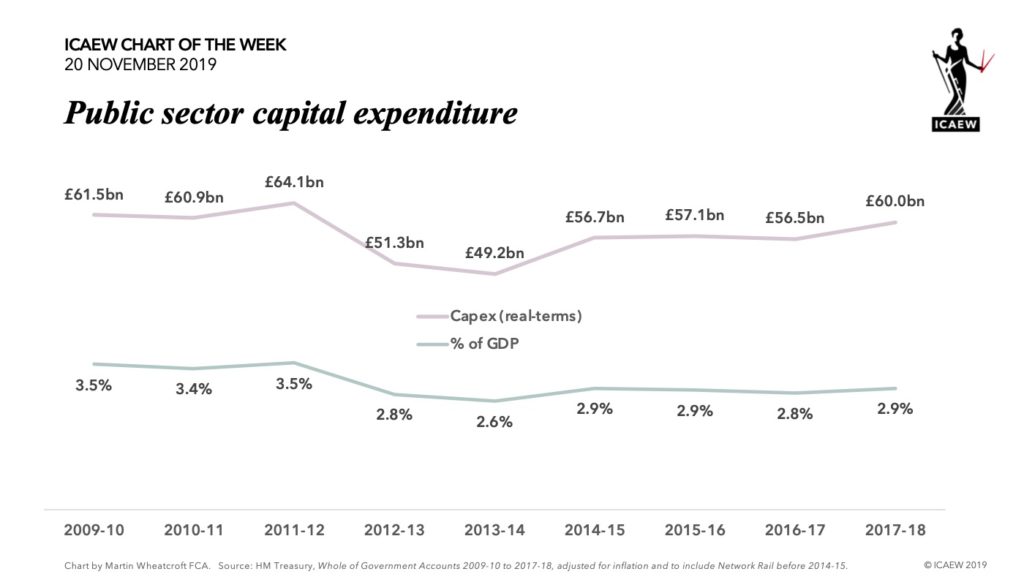

Sustainable infrastructure investment

The shortening of the Spending Review period risks causing uncertainty in departmental capital budgets and the potential for further delays in getting infrastructure projects underway. ICAEW believes that establishing capital budgets for 2023-24, as well as 2022-23, would help departments to be confident in carrying out the groundwork for these projects so that they can be implemented as soon as possible.

The National Infrastructure Strategy is more urgent than ever to reduce regional inequalities and deliver on the ‘levelling up’ agenda.

Data and financial management

ICAEW welcomes the publication of the recent National Data Strategy and the commitment to rethinking how government works set out in the Chief Secretary’s speech of 28 July – digital innovation and better use of data will be key to delivering improved public services at a lower cost. However, sufficient resources must be provided to the initial stages of these projects – the experience of ICAEW members is that underinvestment in planning is one of the major causes of project failure.

Relatively small amounts invested in improving the quality of financial information needed to support effective decision-making, in more efficient and effective finance systems and processes, and in enhancing financial controls such as fraud prevention and detection are likely to be paid back many times over.

A long-term fiscal strategy

One benefit of the delay in the Budget and the deferral of the second two years of the Spending Review is the additional time this will give the government time to think about the longer term and how to put the public finances on a sustainable path.

This is more pressing than ever as strains on public services increase, people live longer, and debt and other public sector liabilities continue to grow.

A comprehensive strategy setting out a framework for taxes, welfare and public services over the next quarter of a century would provide an opportunity for sustainable reform to deliver a robust public balance sheet, a more resilient government machine, and a stronger and more prosperous economy.