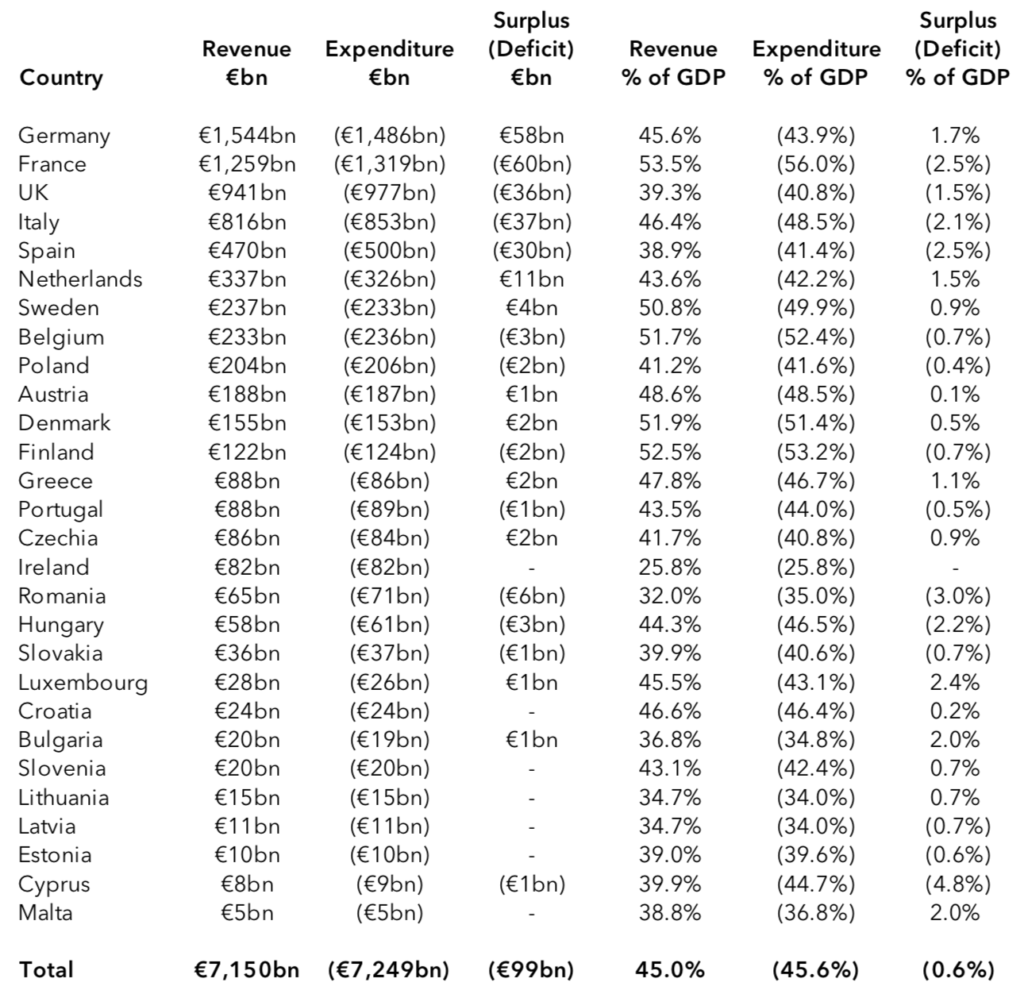

In 2018 public spending by the 28 member states of the EU added up to €7,249bn in total, more than the total of €7,150bn received in general government revenue, a net deficit of €99bn.

It is perhaps not surprising to hear that European governments spent €99bn more than they received in 2018, but as our #icaewchartoftheweek illustrates that there is a big variation between countries. Germany and the Netherlands both generated significant surpluses and so were able to pay down debt, while France, Italy, the UK and Spain all needed to borrow to make up the shortfall in their finances.

Sweden, Greece, Czechia, Denmark, Luxembourg, Bulgaria, Austria, Lithuania, Malta, Slovenia, Croatia and Ireland also generated fiscal surpluses. Although Germany and Netherlands had the largest surpluses in cash terms, Luxembourg (2.4%), Malta (2.0%) and Bulgaria (2.0%) each had higher surpluses as a share of GDP than Germany’s 1.7% and Netherlands’ 1.5%.

These surpluses were more than outweighed by deficits in France, Italy, UK and Spain, while Romania, Belgium, Hungary, Poland, Finland, Cypus, Portugal, Slovakia, Latvia and Estonia also spent more than they had coming in. The largest deficit as a share of GDP was Cyprus (4.8%), while Hungary’s (2.2%) was the other country to exceed 2% of GDP in addition to France (2.5%), Italy (2.1%) and Spain (2.5%). The UK’s deficit was 1.5% of its GDP.

The surpluses and deficits are not the full fiscal picture and so should be treated with a little caution. In particular, they relate to ‘general government’, which includes states, provinces and local authorities, but excludes publicly owned corporations, which can be an important source of income for some countries. They also exclude certain expenditures that would be recognised under generally accepted accounting principles, such as the long-term costs of public sector employee pension obligations.

Even so, there is a clear distinction between countries. France, for example, had to borrow money in 2018, seeing its gross debt increase by €57bn to €2.3tn (98% of GDP), while at the same time Germany cut its debt pile by €52bn to €2.1tn (61% of GDP).

EU-28: General government revenue, expenditure and surplus/(deficit) in 2018