Our choice of chart this week is based on the news that the government is considering increasing fuel duties.

This tax is a good example of the dilemma faced by government. It is a valuable source of revenue – £28bn this year – but government environmental policy is to ban petrol and diesel cars in around 20 years’ time.

The point there will be no fuel to tax might be reached even sooner as the financial incentive for drivers to switch to electric cars is considerable.

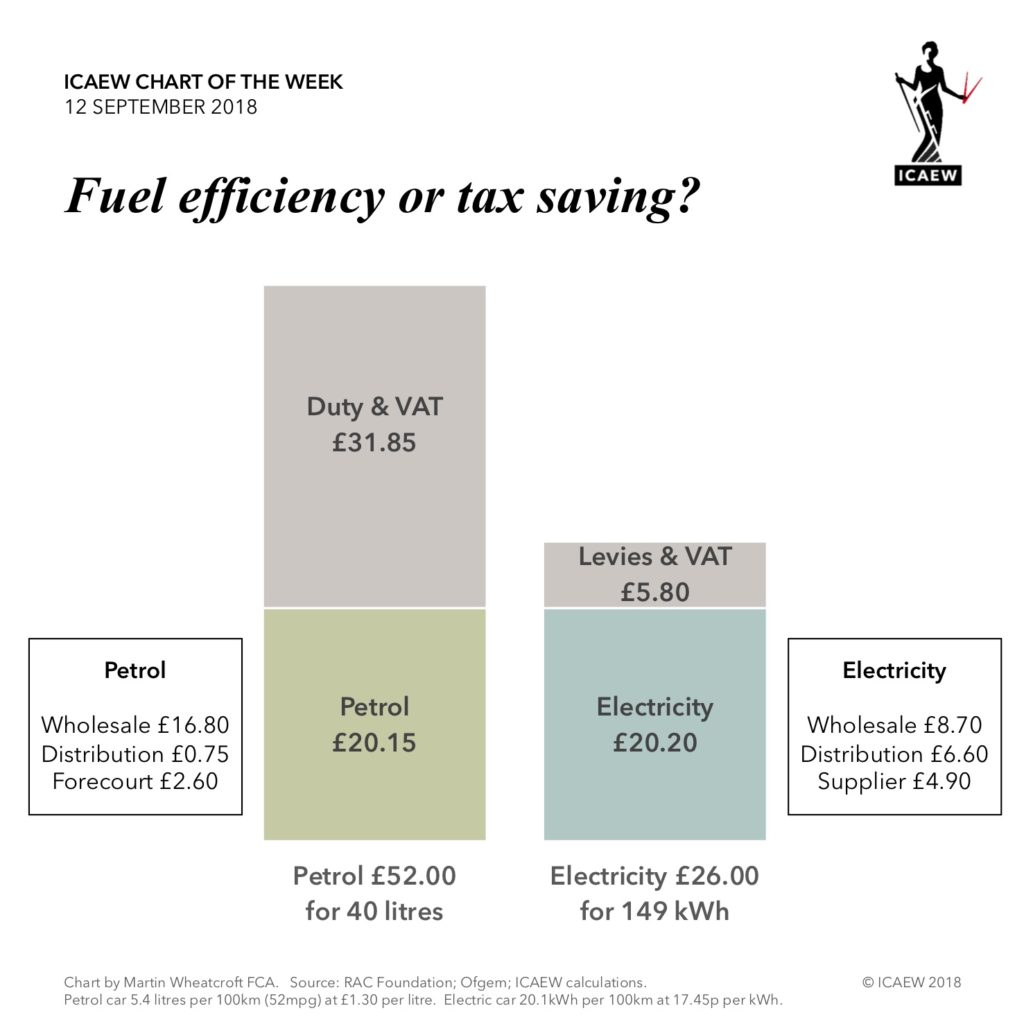

As our chart highlights, we estimate that fuel for a small petrol car to drive 460 miles might cost £52 at current pump prices, around twice the cost of charging an equivalent electric car.

The difference is almost entirely down to tax, with around 60% of the pump price going to the exchequer in fuel duty and full-rate VAT, as opposed to the 22% of domestic electricity charges going in levies for environmental and social obligations and lower-rate VAT.

So the Chancellor’s decision will not just be about the politics of lifting an eight-year freeze in an unpopular tax. Increasing fuel duty might actually accelerate the switch to electric cars and hence the volume of fuel sold.

Suggestions for replacement taxes on a postcard (or electronic equivalent) please.