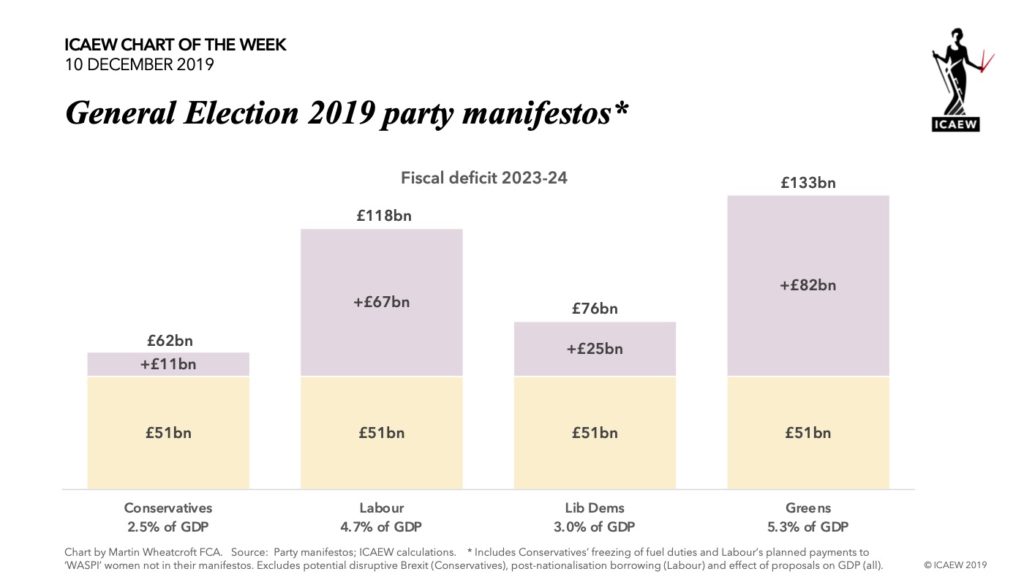

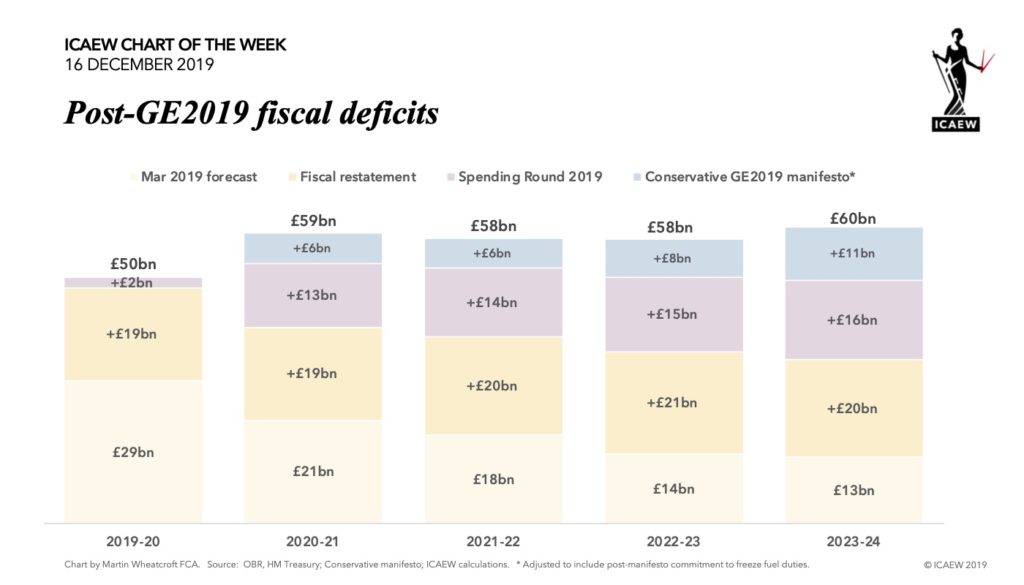

With the General Election now complete, the Office for Budget Responsibility (OBR) was able to release a restated version of its March 2019 fiscal forecasts this morning, reflecting technical revisions to the way the fiscal numbers are calculated, in particular that of student loans. This enables us to update the numbers set out our GE2019 Fiscal Insight on the party manifestos as best we can, given that the OBR has not deigned to include either the changes to public spending announced in the Spending Round 2019 nor the tax and spending changes in the Conservatives manifesto.

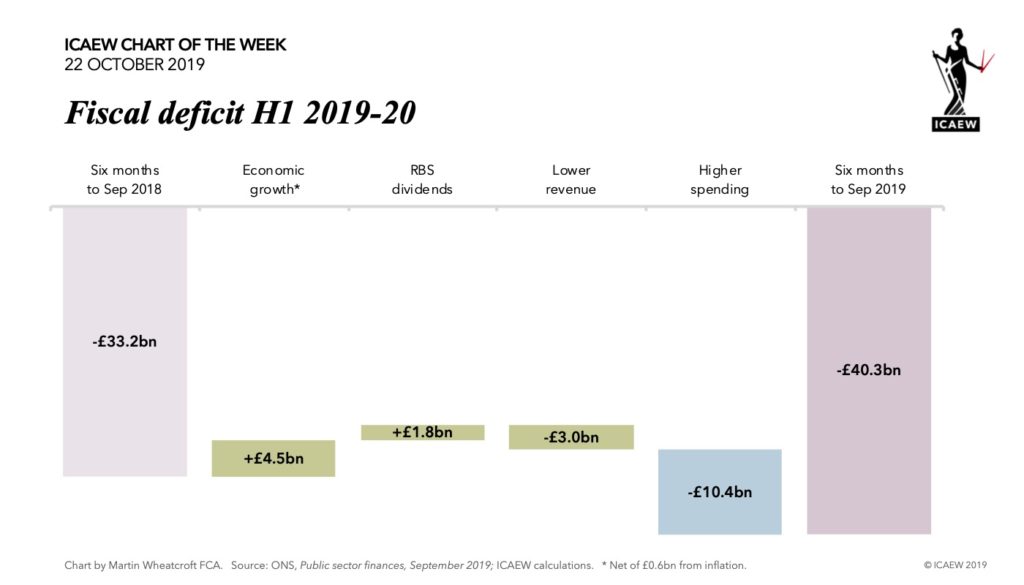

As illustrated by the #icaewchartoftheweek, the revised baseline forecast for the fiscal deficit is now £50bn for the current fiscal year, followed by £59bn next year in 2020-21, £58bn in 2021-22 and 2022-23 and £60bn in 2023-24.

It was frustrating that the OBR scheduled their publication of these revised numbers for the first day of the General Election purdah period making it vulnerable – as happened – to being pulled. A day earlier and that would not have happened! Ideally, these revisions would have been published as soon as practical after the publication by the ONS of their revisions to historical numbers in September.

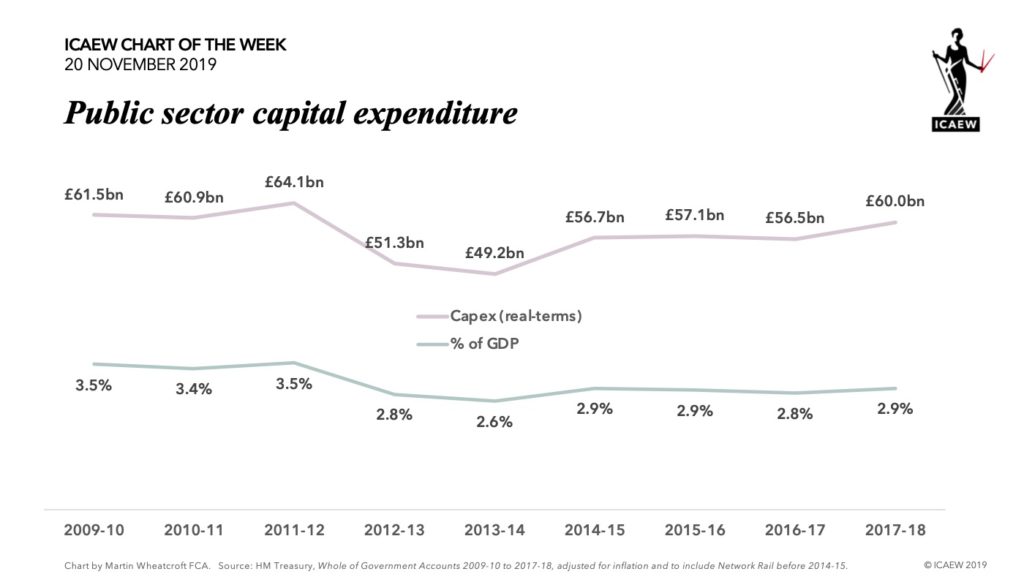

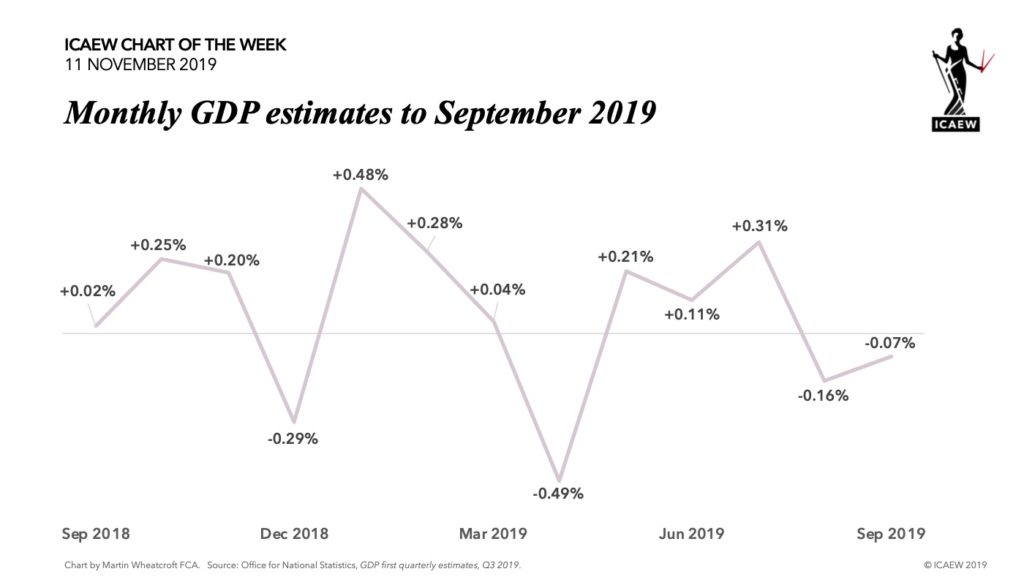

It would have been even better if the OBR had been able to update their economic forecast too, given that the current baseline is still based on an economic and fiscal analysis from nine-months ago. With weak economic growth over the first half of the financial year, it is likely that the OBR will cut its forecasts for tax revenues over the forecast period when it does get round to updating them, resulting in higher deficits – even before taking account of suggestions that the Conservative GE2019 winners plan to announce a splurge of more capital expenditures in the Spring Budget in February.

Unfortunately, we won’t see an updated long-term forecast until at least July 2020, when the OBR is scheduled to publish its next fiscal sustainability report on the prospects for the public finances.